Financing a Car: How to Get a Car Loan

How to Get a Car Loan and Secure The Best Rates

Are you thinking about buying a car? You're not alone. For many people, a car is necessary for daily life, but the cost can be challenging. That's where financing a vehicle can help.

Getting a car loan can make owning a vehicle more affordable by spreading the cost over time. But how do you get started? How do you know what kind of loan is right for you?

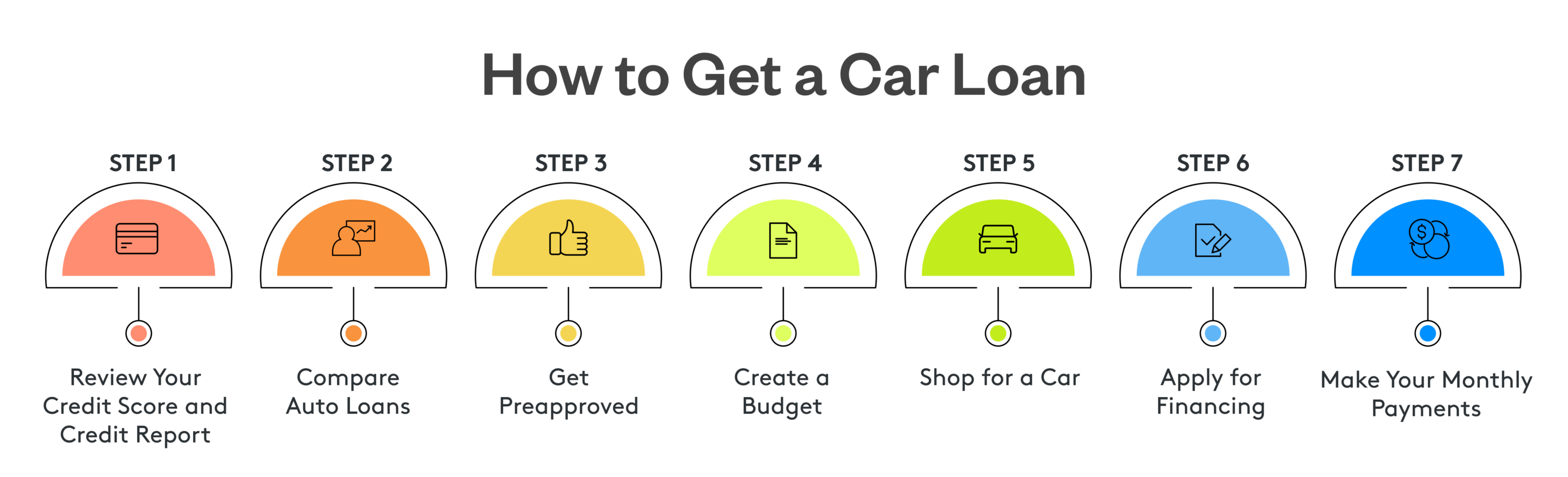

This guide will walk you through how to get a car loan step by step. Whether you're a first-time car buyer or you've been through this process before, you'll find helpful information that covers everything from checking your credit score to making your monthly payments.

Key Takeaways

- It's often recommended to review your credit report before applying for a car loan, as the information can help you determine your ability to secure a favorable auto loan

- Comparing auto loans from various lenders, including banks and credit unions, can help you find the best interest rates and terms for your financial situation

- Getting preapproved for a car loan provides a clear budget for your car purchase, though it doesn't guarantee final approval

- Creating a comprehensive budget that includes the monthly car payment and insurance, gas and maintenance costs is essential for responsible car ownership

- Making timely monthly payments on your auto loan ensures you maintain a good credit score and don't put yourself at risk of repossession

1. Review Your Credit Score and Credit Report

Your credit score is a number used by lenders to inform them about how well you handle your money and debts. It's essential when you want to get a loan for a car, as it shows lenders how trustworthy you are when repaying loans. You can get a free credit report once a year from each of the three main credit bureaus, Experian, Equifax and TransUnion, by visiting AnnualCreditReport.com.

Why does this matter? A good credit score can help you get a better deal on your auto loan. Auto loan lenders review your credit score to decide if they want to give you a loan and what interest rate to charge.

2. Compare Auto Loans

When you're looking to finance a car, don't take the first loan you find. Instead, take time to shop around. Consider auto loans from credit unions, banks and online lenders.

When comparing loans, pay attention to these factors:

- Interest rates: The lower your interest rate, the less you pay overall

- Loan term: Longer loan terms result in lower monthly payments, but you'll pay more interest over time

- Fees: Beware of origination fees, prepayment penalties and other charges that could increase the overall cost of the loan

- Down payment requirements: Some lenders might offer better rates if you can make a larger down payment

Even a slight difference in rates can save you money over time. For example, on a $20,000 loan over 60 months, the difference between a 4% and 5% interest rate is about $545 over the life of the loan.

Also, be aware that multiple loan applications within a short period (usually 14-45 days) are typically counted as a single inquiry on your credit report. This allows you to shop around without worrying about hurting your credit score.

3. Get Preapproved

Getting preapproved for a car loan can help with the car-buying process. A preapproval means a lender has looked at your finances and decided how much they will lend you. This helps set your budget by showing you how much you can afford to spend on a car.

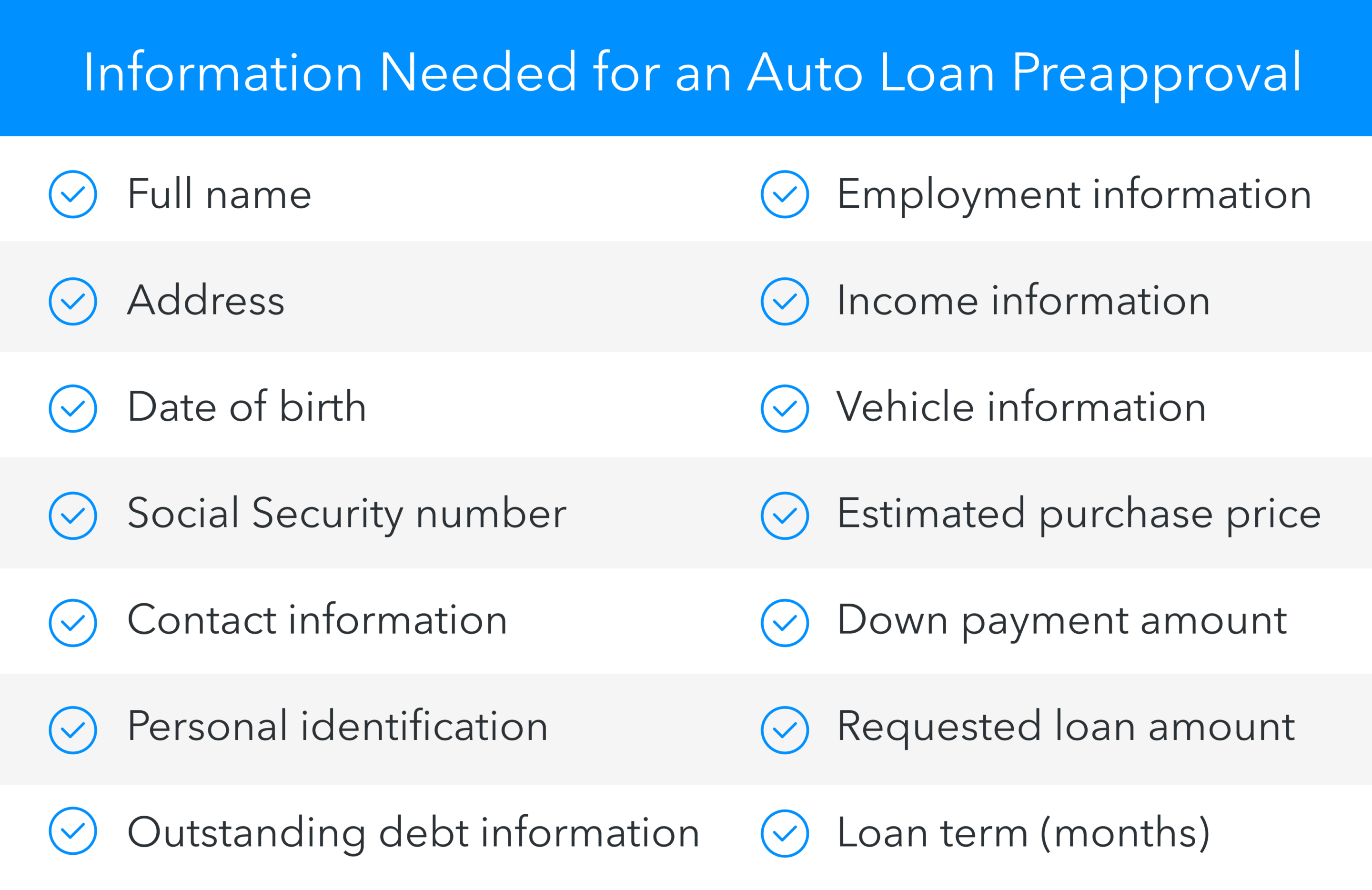

To get preapproved, you'll need to give the lender some information. This usually includes:

- Your name, address, and date of birth

- Social Security number

- Contact information

- Personal identification, such as a driver’s license

- Outstanding debt information

- Employment information

- Income information

- Vehicle information

- Estimated purchase price

- Down payment amount

- Requested loan amount

- Loan term (months)

Keep in mind that preapproval also doesn't mean you're guaranteed the loan once you apply. Instead, it tells you a lender's estimate of how much they might be willing to lend you based on the initial information you provided. The final loan terms may change once you've chosen a specific car and the lender thoroughly reviews your finances.

At California Credit Union, we can help with Auto Loan Pre-Approval. Whether you're eyeing a brand-new model or a reliable used vehicle, our pre-approval process lets you shop with confidence knowing exactly how much you can afford.

4. Create a Budget

It's crucial to create a budget to help you see how much you can afford to spend on your monthly car payments.

Remember, the cost of a car isn't just the monthly payment. You also need to think about:

- Insurance

- Gas

- Maintenance

- Parking

A car loan calculator can help you determine what your monthly payments might be. With this number, you can then add the other costs of owning a car to help you set a realistic budget.

5. Shop for a Car

Once you know how much you can spend, it's time to find your car. Visit different dealerships and compare prices. Don't be afraid to negotiate. Remember, the price on the sticker isn't always the final price.

6. Apply for Financing

After finding the car you want, you can apply for financing. If you're already preapproved, you might be able to work with the lender to streamline the application process. If not, you'll need to apply now.

The lender will ask for some documents. These might include:

- The agreement to buy the car

- Proof of income, such as a pay stub, bank statement, tax return or W-2 Form

- Proof of insurance

7. Make Your Monthly Payments

After buying your car, you'll need to start making monthly payments on your auto loan. It's essential to make these payments on time. While late payments can impact your credit score and might lead to extra fees, the biggest risk of missing payments is repossession. If you fall too far behind on your payments, the lender may have the right to take back the car to recoup their losses.

Most car loans last for a set number of months. Common auto loan terms are 36, 48, 60 or 72 months. Remember, a longer loan means lower monthly payments, but you'll pay more interest over time.

Wrapping Up: How to Get an Auto Loan

Getting a loan for a car doesn't have to be hard. By following these steps, you can make the process much easier. Remember, take your time and don't rush into anything. A car is a big purchase, and you want to ensure you get the best deal possible.

Consider California Credit Union's offerings when you're ready for an auto loan. We offer competitive rates and excellent member services to help you get a car loan.

All loans are subject to approval. Rates, terms and conditions are subject to change. Fees and charges may apply.