What Is a Digital Wallet? A Complete Guide

Everything You Need to Know About Digital Wallets

Digital wallets have changed how we pay for things, making transactions faster and more secure. Whether you're shopping online or checking out at a store, digital wallets offer a convenient alternative to carrying physical cards and cash.

Key Takeaways

- Digital wallets store your payment information securely, keeping your credit cards, debit cards and banking details in one encrypted place on your phone or computer

- Your card numbers are never shared with retailers during transactions, making digital wallets more secure than traditional payment methods through tokenization

- Most digital wallets can be configured in just a few minutes by downloading an app and linking your payment method

- Fingerprint scanning, facial recognition and multi-factor authentication helps protect your financial information

What Is a Digital Wallet?

A digital wallet stores payment information on your smartphone, computer or other device. Instead of carrying plastic cards, you keep your credit card numbers, debit card information and bank account details in one secure digital location.

Common examples of digital wallets include Apple Pay, Google Wallet and Samsung Pay. These platforms let you make purchases without your physical cards, working for both in-person payments at stores and online transactions. Many digital wallets also hold event tickets, gift cards and membership cards.

At California Credit Union, we pleased to offer Digital Wallet as part of our Digital Banking services. Learn more here.

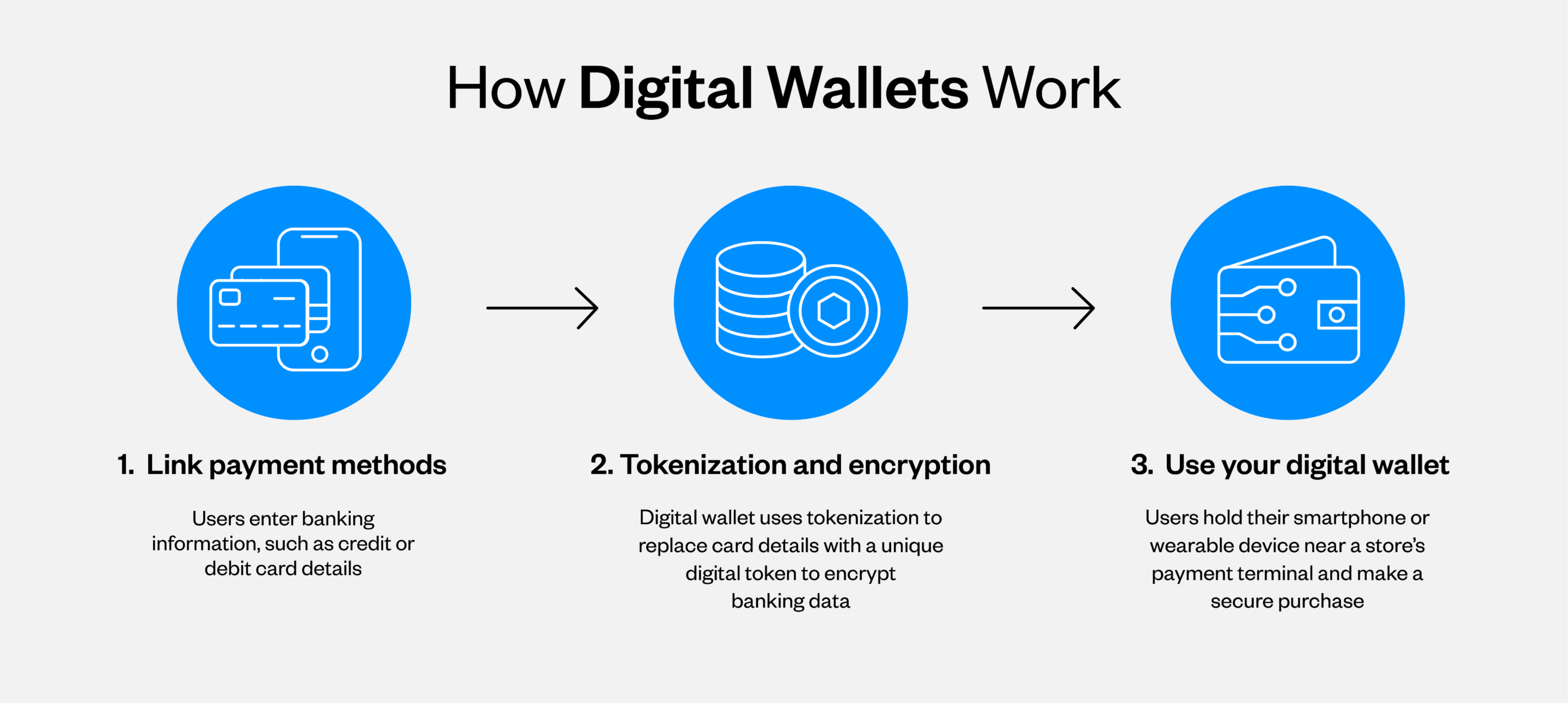

How Do Digital Wallets Work?

The technology behind digital wallets is straightforward once you understand the basics. If you're opening your first bank account, make sure you ask whether they integrate with digital wallets. Here's how digital wallets work:

- Linking payment methods: Start by connecting your payment sources through the wallet app. This involves entering your credit card or debit card information, or linking directly to your bank account. You'll need to provide details like the card number, expiration date and security code. Some wallets also link directly to your checking account or savings account. Many banks and credit unions offer instant verification so you can use your card right away

- Tokenization and encryption: When you add a payment card, the system doesn't store your real card number. Instead, it uses tokenization to replace your card details with a unique digital token. This encrypted token gets transmitted during transactions, so your actual card number never leaves your device or gets shared with merchants

- Using your digital wallet: For in-store purchases, unlock your phone and hold it near the payment terminal. The device uses near-field communication (NFC) technology to transmit the payment token. With in-store debit card purchases you may also be prompted to enter your PIN for additional verification. For online shopping, select your digital wallet at checkout and complete the purchase with a click or fingerprint scan. You can also send money to friends and family without cash or checks.

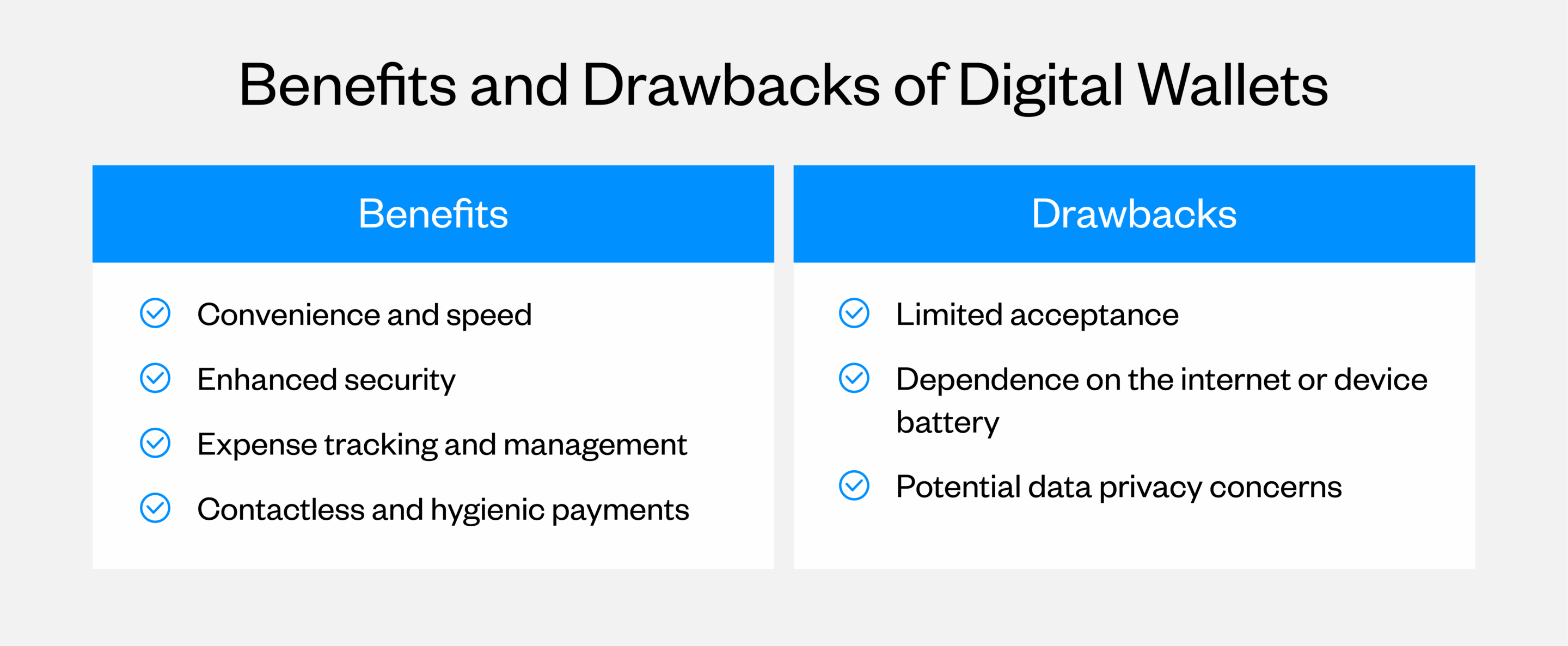

Benefits of Digital Wallets

Digital wallets offer several advantages to consumers looking for convenience and security. These benefits include:

- Convenience and speed: Digital wallets make transactions faster. Instead of searching for the right card, you pull out your phone and tap. Everything you need is on your device, eliminating the need to carry multiple cards

- Enhanced security: Digital wallets are often safer than physical cards. Tokenization means merchants never see your actual card number, reducing data breach risks. Additionally, if someone steals your phone, they won't be able to access your wallet without your PIN, fingerprint or face scan

- Expense tracking and management: Most digital wallets automatically categorize and record purchases, creating a digital record of your spending. This built-in tracking makes it easier to see where your money goes each month without sorting through receipts. When you can see your spending patterns clearly, you can find ways to save that you might have missed otherwise

Potential Drawbacks of Digital Wallets

Digital wallets might not be for everyone. Here are some limitations to consider:

- Limited acceptance: Not every business accepts digital wallet payments yet. Small local shops, farmers' markets and some service providers may only take cash or physical cards. You'll still need a backup payment method for these situations

- Dependence on the internet or device battery: Digital wallets require sufficient battery power and often an internet connection. If your phone or wearable device runs out of battery, you can't access your payment methods. This is especially problematic if you've left your physical wallet at home

- Potential data privacy concerns: Using digital wallets means sharing purchasing data with the wallet provider. While this information is encrypted and protected, some people may feel uncomfortable with companies having detailed spending records. Different providers have varying privacy policies, so read the terms of service before choosing a platform

How to Set Up and Use a Digital Wallet

Getting started with a digital wallet takes just a few minutes. Here's how to use a digital wallet:

- Choose your digital wallet: Select which digital wallet fits your needs. iPhone users often choose Apple Pay, while Android users might prefer Google Wallet. Think about where you shop most frequently and which payment methods those businesses accept

- Add cards or bank accounts: Download your chosen wallet app and add payment methods like credit or debit cards. You can manually type in card information or use your smartphone's camera to scan the card. Most digital wallets accept both options, so understanding debit vs. credit card differences can help you decide which to link first

- Verify payment method: After entering your payment information, verify that you own the card or account. This might mean receiving a text message with a confirmation code, approving through your bank's app, or making a small test transaction

- Enable extra security features: Set up additional security features like a PIN, fingerprint authentication or facial recognition. These features ensure that even if someone steals your phone, they can't access your payment information

- Start using your wallet: Try using your digital wallet at a familiar store where contactless payments are accepted. After a few successful transactions, the process will feel natural

Security Tips for Digital Wallet Users

Keeping your digital wallet secure comes down to following some basic security practices. Here are essential steps to protect your financial information.

- Use strong, unique passwords: Create passwords for your wallet apps that avoid easily guessed information like birthdays, pet names or simple number sequences

- Enable multi-factor authentication: Add an extra layer of protection with a second form of verification when logging in from new devices

- Download only official apps: Get wallet apps exclusively from legitimate app stores to avoid fake apps designed to steal your information

- Keep software updated: Regularly update your device's operating system and digital wallet apps to ensure you have the latest security patches

- Review transactions regularly: Check your transaction history frequently and report anything unfamiliar immediately to your wallet provider and bank

Read these debit card security tips for additional protection strategies.

Wrapping Up: Final Thoughts on Digital Wallets

Digital wallets combine the convenience of having all your payment methods in one place with security features that often exceed traditional cards. Whether you're using them for quick purchases, online shopping or splitting expenses with friends, digital wallets can simplify your financial life and provide better visibility into your spending habits.

If you're ready to embrace digital banking and experience the benefits of a credit union, California Credit Union offers the tools and support to make the transition smooth. Our accounts integrate seamlessly with popular digital wallets, giving you the flexibility to manage your money however works best for you. With personalized service and a commitment to helping members achieve their financial goals, we're here to support your journey toward smarter, more secure banking.