Buy vs. Lease Equipment Calculator

Starting a new venture requires meticulous planning, and one of the foremost considerations is to calculate the costs of starting a business. Equipment is a fundamental aspect of your business, but deciding whether to buy or lease can impact your company’s long-term financial health.

Whether you’re calculating the costs for machinery or transport, tools like our Buy vs. Lease Equipment Calculator and our Vehicle Payments Calculator can guide your decision.

Is it better to buy or lease equipment for my business?

Deciding whether to buy or lease equipment for a business depends on various factors that range from one company to another. The choice often depends on the business’s financial standing, equipment’s projected lifespan, tax implications, cash flow considerations and operational flexibility.

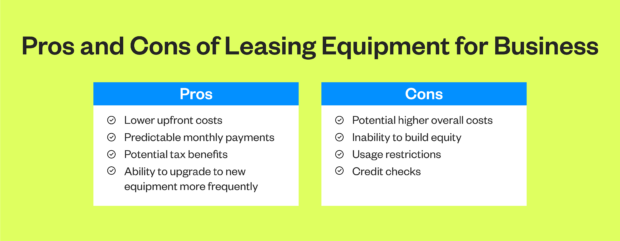

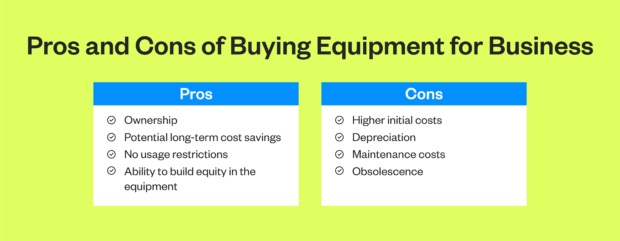

Buying offers a sense of permanence and could be more cost-effective in the long run, especially for equipment vital to the business’s core operations. On the other hand, leasing provides flexibility and requires less upfront capital, making it ideal for equipment that may become obsolete quickly. Furthermore, consistently meeting lease payments or timely repayments on financed equipment can be a factor in how to build good credit for your business.

Equipment Lease Calculator

Try our business equipment lease calculator to compare buying and leasing your equipment. By inputting key financial parameters, our calculator offers a comparative analysis to shed light on the long-term financial implications of each choice.

Explore Your Options

Our Equipment Buy vs. Lease Calculator should have provided you with the essential information you need to determine the best option for your business. California Credit Union understands the diverse financial needs of businesses. Our borrowing options provide flexibility and competitive rates to fit your lifestyle. Whether you’re investing in new equipment or expanding your business, we’re your trusted partner.