Share Certificate Calculator

Give Your Savings a Boost with Our Share Certificate Calculator

Planning your savings strategy gets a lot easier when you know exactly what your money will earn. Our free share certificate calculator takes the guesswork out of fixed-rate investing by showing you the dividends you’ll earn before you commit your funds. With rates typically higher than traditional savings accounts, Share Certificates are a great way to earn more dividends than your standard savings account in a safe and secure short-term investment.

Key Takeaways on Share Certificates

- A share certificate dividend calculator shows your exact earnings before you invest. By entering your deposit amount, term length and APY, you can see your total dividends and final balance at maturity, making it easier to compare different certificate options and choose the best fit for your goals

- The calculator accounts for compounding to give accurate projections. Since most share certificates compound monthly or quarterly rather than annually, the calculator factors in how often dividends are credited to your account, showing you the true earnings you’ll receive

- You can test multiple scenarios to optimize your returns. Use the calculator to compare how different deposit amounts, term lengths and dividend rates affect your final payout, helping you find the right balance between accessibility and earnings

- Credit union share certificates work like bank CDs but pay dividends. The calculator works the same way for both products since the math is identical, though credit unions pay dividends to member-owners rather than interest to customers

What Is a Share Certificate?

A share certificate is a fixed-term savings vehicle from a credit union that pays members a set dividend rate until maturity. You deposit a specific amount of money for a predetermined term — anywhere from a few months to several years — and in exchange, you receive a guaranteed return on your investment. The dividend rate stays locked in for the entire term regardless of what happens with market rates. The predictability of share certificates makes them valuable for savers who want guaranteed returns without market volatility. These certificates can be valuable tools whether you’re learning how to save money more effectively or building funds to save for retirement.

A share certificate is a credit union’s equivalent of what banks call a certificate of deposit (CD). The mechanics work the same way, but there’s an important distinction in how credit unions vs. banks operate. Credit unions are member-owned cooperatives, so they pay dividends to their members rather than interest to customers.

At California Credit Union, we offer share certificates with dividend rates designed to grow your savings faster, allowing you to earn more than typical savings accounts.

The Impact of Compounding Frequency on Share Certificates

Not all share certificates compound dividends at the same frequency, and this timing makes a meaningful difference in what you ultimately earn. Some compound monthly, others quarterly and some only once per year. The more frequently your dividends compound, the faster your money grows.

When dividends compound monthly, the dividends you earn in January get added to your principal balance. In February, you earn dividends on your original deposit plus January’s dividends. This cycle continues throughout your term, with each month’s dividends becoming part of the base that earns dividends the following month.

Compare that to annual compounding, where you only get the benefit of compounding once at the end of the year. Using a $15,000 deposit at 4.3% APY, monthly compounding would give you a few extra dollars compared to annual compounding over a one-year term. The difference seems small on a short timeline, but it becomes more pronounced with larger deposits or longer terms.

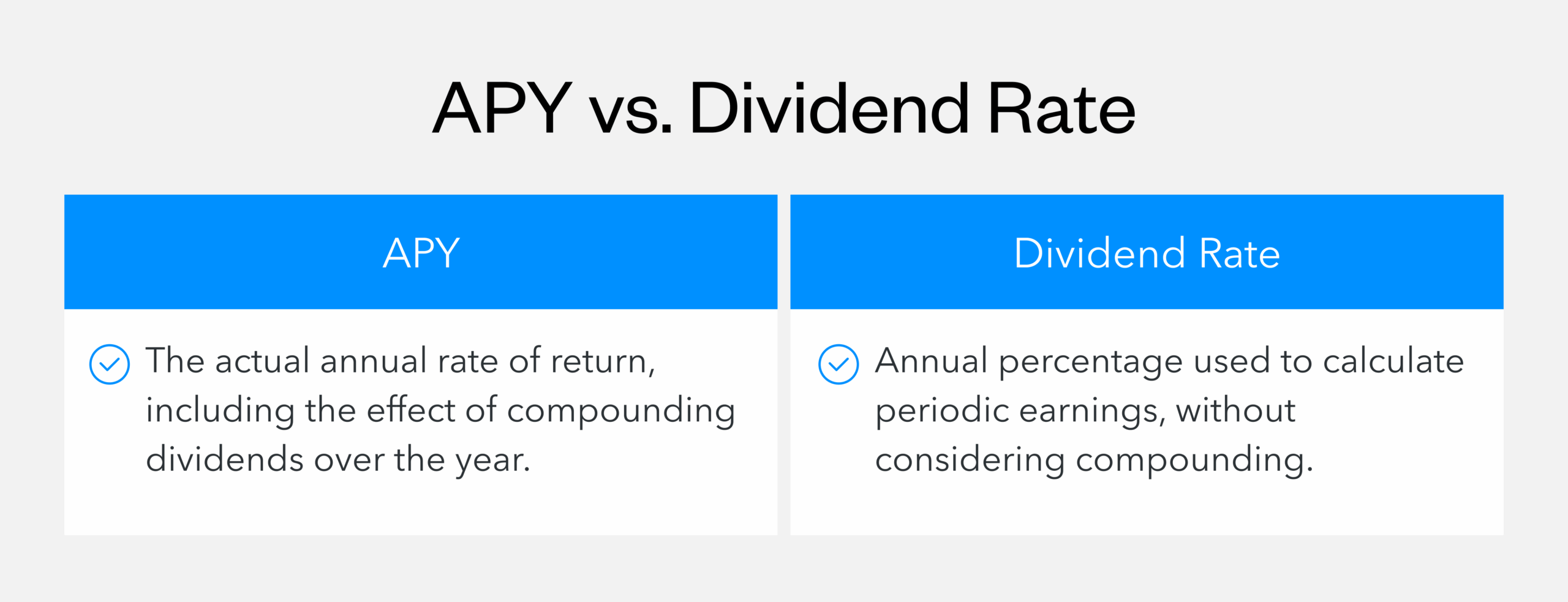

When you're comparing share certificates from different institutions, pay attention to both the stated rate and how often it compounds. A slightly lower rate with monthly compounding can sometimes outperform a higher rate that compounds annually. Our share certificate calculator accounts for these differences, which is why it asks for the APY rather than just the base dividend rate.

Factors That Can Affect Your Share Certificate Earnings

While share certificates offer predictable returns, a few variables can impact what you actually take home at maturity. Knowing what these factors are can help you choose the right product and avoid surprises down the road.

- Early withdrawals: Most share certificates impose penalties if you take out your money before the maturity date. These penalties typically eat into your earned dividends, and in some cases, they can even reduce your principal. The penalty structure varies by institution and term length, but it’s designed to discourage you from pulling out early. This is why you should only deposit money you’re confident you won’t need during the certificate term

- Rate changes on variable-rate share certificates: While most share certificates come with a fixed rate, some institutions offer variable-rate options where the dividend rate can adjust based on market conditions or a predetermined schedule. These certificates might start with a lower rate that increases over time, or they might fluctuate with an index. Variable-rate certificates introduce uncertainty into your returns, so make sure you understand the terms before choosing this option

- Minimum balance requirements: Share certificates typically require a minimum deposit to open the account, and you must maintain that balance throughout the term. For example, California Credit Union’s share certificates often require at least $1,000 to get started. If you fall below the minimum balance due to fees or partial withdrawals, you might lose the promotional rate or face additional penalties. Check the requirements upfront to make sure the certificate fits your financial situation

These factors don’t make share certificates risky, but they do require you to plan ahead. Choose a term you can commit to, understand whether the rate is fixed or variable and confirm you can meet the minimum balance requirement for the entire period.

Wrapping Up: Calculating Earnings on Your Share Certificate

Ready to start saving? California Credit Union offers share certificates with competitive dividend rates across different terms to match your timeline. Take the next step by opening a Share Certificate with California Credit Union and start building your future today.

California Credit Union cannot and does not guarantee the accuracy or the applicability to your individual circumstances. All examples are hypothetical and are for illustrative purposes. Calculator results are estimates based on information you provided and California Credit Union does not guarantee your ability to receive these terms. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.