How Does Credit Card Interest Work? A Complete Guide

Credit card interest is what you pay to borrow money from your card issuer. When you make a purchase with your credit card and don’t pay off the full balance by the due date, the remaining amount gets charged interest. This is different from fees, which are flat charges for specific actions. Interest is calculated as a percentage of your outstanding balance and compounds over time.

The more you carry on your card, the more interest accumulates. Most credit cards use compound interest, meaning you pay interest on both your original balance and previously charged interest. This can cause debt to grow faster than expected, especially if you’re only making the minimum payments.

Key Takeaways

- Credit card interest is the cost of borrowing money when you carry a balance

- APR is the annual cost of borrowing, while the daily periodic rate determines how interest accrues each day

- Different types of APRs apply to various transactions, including purchases, balance transfers and cash advances

- Paying your full statement balance before the due date helps you avoid interest charges entirely

- Missing payments can trigger penalty APRs and damage your credit score

What Is the Difference Between Credit Card Interest Rate and APR?

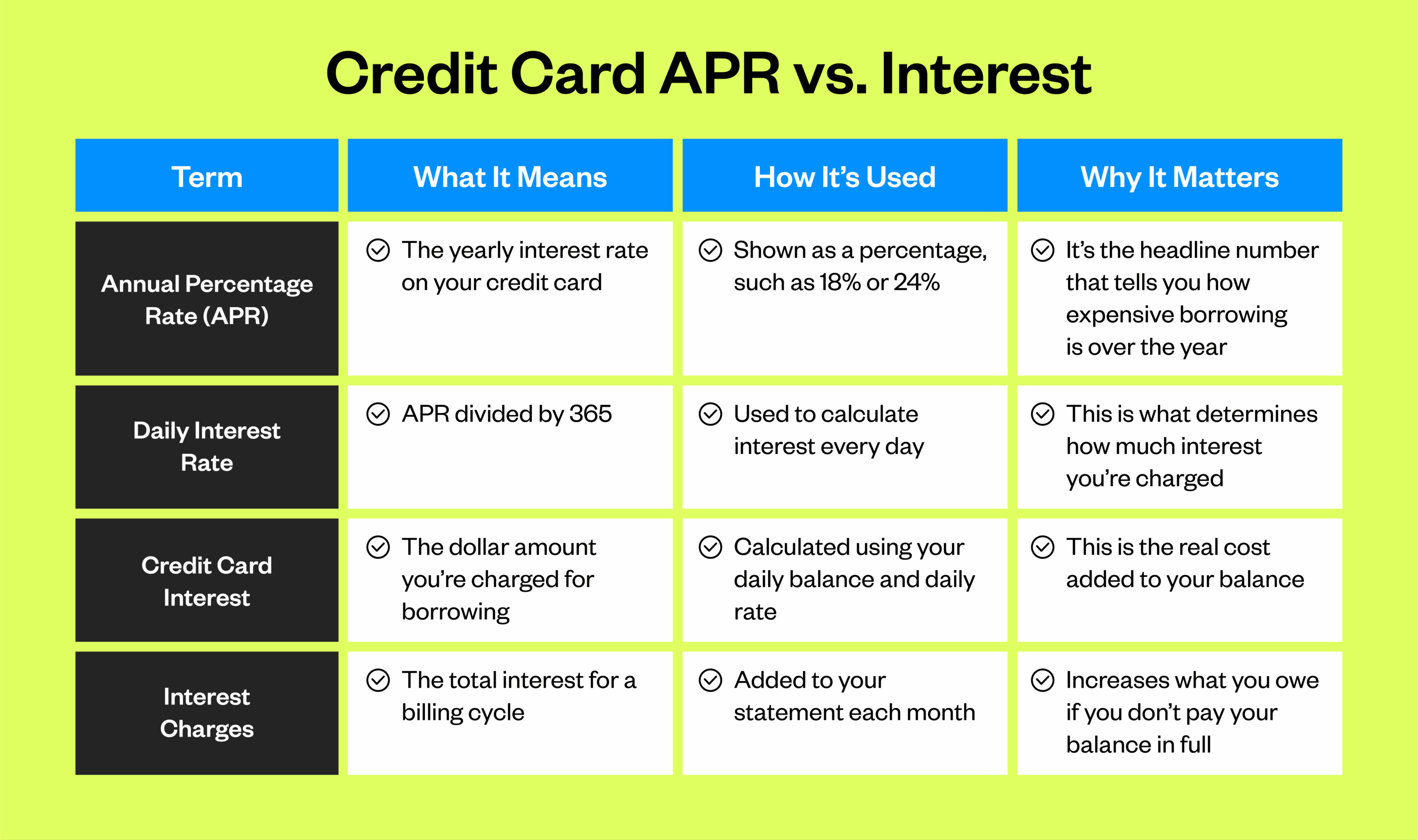

People often use “interest rate” and “APR” interchangeably when talking about credit cards, but there’s a difference. Here’s what each term means:

- Annual percentage rate (APR): This is the yearly cost of borrowing on your credit card. Your APR is expressed as a percentage and includes your interest rate plus additional fees. The advertised rate on a credit card offer is typically the APR

- Daily interest rate: Also called the daily periodic rate, this is your APR divided by 365. Card issuers then use this rate to calculate daily interest charges

- Credit card interest: This refers to the actual dollar amount you’re charged for borrowing, calculated by applying your daily rate to your balance by the number of days in your statement period

- Interest charges: These are the fees that appear on your statement when you carry a balance. They represent the total interest that accumulated during that billing period

What Are the Different Types of APRs on Credit Cards?

Your credit card likely has several different interest rates depending on how you use it. Different types of APRs apply to various transactions and card types. Here are the most common types of credit card interest:

- Fixed-rate APRs: Despite the name, these rates aren’t actually permanent. A fixed-rate APR can still change, but your card issuer must give you advance notice. These rates tend to be more stable than variable rates, though they’re less common nowadays

- Variable-rate APRs: Most credit cards today use variable rates that fluctuate based on an index, usually the prime rate. When the Federal Reserve raises or lowers rates, your card’s APR will likely follow

- Penalty APRs: If you miss a payment, your card issuer might apply a penalty APR. These rates are significantly higher than your regular APR and can apply to both your existing balance and future purchases. Some penalty rates can last indefinitely, while others revert after several months of on-time payments

- Cash advance APRs: Taking cash out with your credit card may come with a higher APR than regular purchases. Cash advances also start accumulating interest immediately with no grace period, and they often include additional fees

- Introductory APRs: Many cards offer introductory rates, sometimes as low as 0%, for a limited time when you first open the account. These rates typically last six to 18 months before jumping to the standard APR

- Promotional APRs: Many card issuers offer promotional APRs when your account is in good standing. The promotional APR is a reduced rate for a period of time. After the promotional period, the unpaid remaining balance will revert back to the standard APR.

- Balance transfer APRs: When you move debt from one card to another, a special balance transfer APR might apply. Some cards offer low or 0% introductory rates on transfers, though there’s usually a transfer fee involved

How Is Credit Card Interest Calculated?

The most common way credit card companies calculate interest is with the daily balance method. Your credit card statement shows your APR, but that’s an annual rate. Since interest gets charged daily, you need to convert it to a daily periodic rate. Here’s how the calculation works:

- Calculate your daily APR: Divide your annual APR by 365. An 18% APR becomes 0.0493% daily

- Calculate your average daily balance: Add your balance for each day, then divide by the number of days. For example, if you have a $1,000 balance for the first 15 days of a 30-day cycle, then make a $200 payment so your balance is $800 for the remaining 15 days, your calculation would be: (15 days × $1,000) + (15 days × $800) = $27,000 ÷ 30 days = $900 average daily balance

- Apply the daily interest rate: Multiply your average daily balance by your daily periodic rate. For example, $900 × 0.000493 = $0.44 per day

- Multiply by billing days: Take the daily interest and multiply by the number of days in your statement period. At 30 days: $0.44 × 30 = $13.20

- Add the interest to your statement: That amount gets added to your balance. Starting with a $900 average balance, you’ll owe $13.20 in interest charges

The higher your balance and the longer you carry it, the more interest accumulates. That’s why paying down your balance quickly saves you money.

When Do Credit Cards Charge Interest?

Knowing how to use a credit card means understanding when interest starts accruing. Most cards offer what’s called a grace period, typically 21 to 25 days after your statement closing date. During this window, you won’t be charged interest on new purchases as long as you pay your full statement balance by the due date.

That said, grace periods don’t apply to everything. For example, if you get a cash advance, you can expect interest to start accruing immediately. If you’re already carrying a balance from a previous month, new purchases may also begin accumulating interest right away, depending on your card’s terms.

If you pay less than your full balance, interest gets calculated on the remaining amount and is added to what you owe when the statement is generated. The cycle continues each month until you either pay off the balance completely or close the account.

Wrapping Up: Understanding Credit Card Interest

Credit card interest doesn’t have to be confusing once you understand the basics. Knowing how interest is calculated, when it’s charged and which factors affect your rate puts you in control. Use that knowledge to develop smart habits like paying your balance in full and making payments early.

At California Credit Union, we offer competitive rates and member-focused service. Whether you’re looking to transfer a balance or open a new card, we provide tools to help you succeed. Visit us to explore our options and discover how to save money on interest. Plus, with the ability to manage your card with a digital wallet, taking care of your financial health has never been easier.