What Are the Differences Between a Money Market Account vs. Savings Account?

Money market accounts and savings accounts are both safe places to store your money and earn interest—but they work a little differently. Understanding those differences can help you choose the right option based on how often you need access to your funds and how much interest you want to earn.

When considering ways to save, money market or savings accounts are popular choices for those who need a safe place to deposit their money while earning interest. Before diving into the specifics of each account, it's essential to address the fundamental question: what is the difference between a money market and a savings account?

What Is a Savings Account?

A savings account is a safe place to keep your money while earning interest. Banks and credit unions offer savings accounts to help you set aside funds for short- or long-term goals.

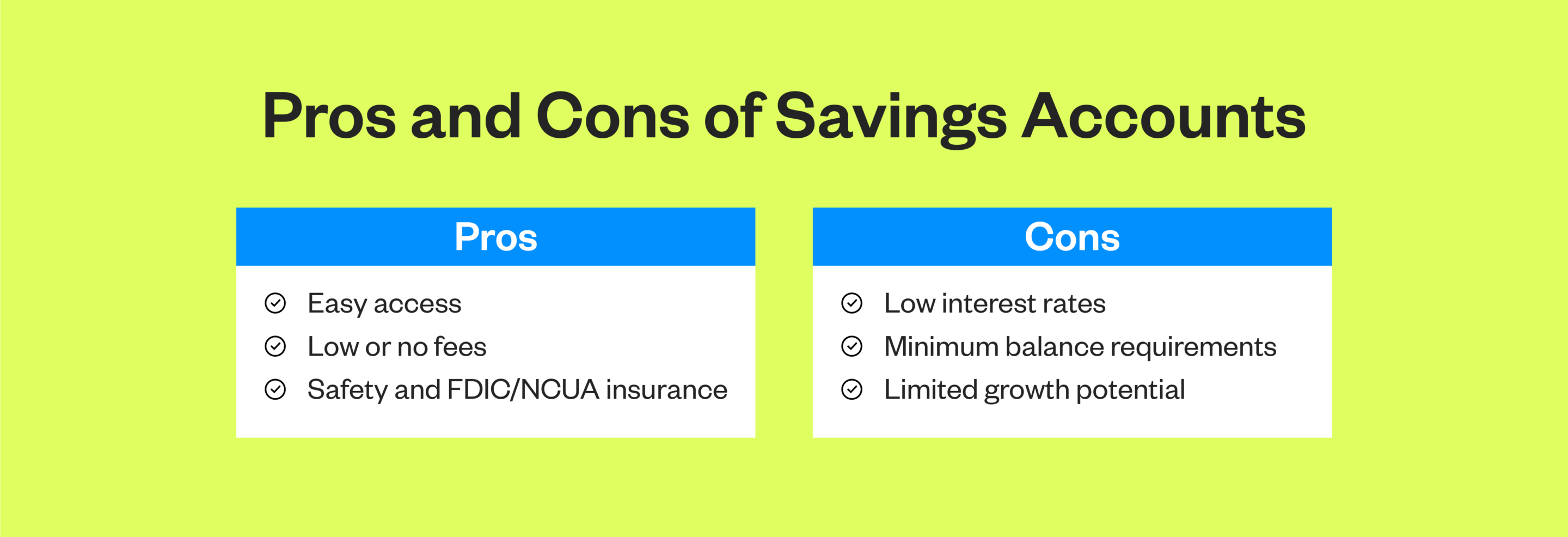

Pros of savings accounts

Savings accounts are simple, secure and accessible. A few benefits of savings accounts include the following:

- Easy access: One of the primary benefits of savings accounts is their liquidity. Account holders can easily withdraw or transfer their money without facing penalties or long processing times. This can be particularly valuable for those focused on paying off credit card debt while strengthening their credit score over time

- Low or no fees: Many credit unions and banks offer savings accounts with minimal fees, which allows the account holder to save without the worry of diminishing returns due to regular charges

- Safety and FDIC/NCUA insurance: Savings accounts are typically insured by the FDIC or NCUA, which means your money is protected if the bank or credit union fails

Cons of savings accounts

While savings accounts offer undeniable benefits like security and accessibility, they're not without their drawbacks. Here are some common downsides:

- Low interest rates: In environments where interest rates are low, the earnings on a savings account might not outpace inflation, meaning the real value of the money might diminish over time.

- Minimum balance requirements: Some savings accounts require account holders to maintain a minimum balance to avoid fees or qualify for certain benefits, like higher interest rates. This can be restrictive for some individuals, especially those who may need to dip into their savings frequently.

- Limited growth potential: While savings accounts are a safer and more stable environment to store your money, they're not always the best choice for those looking to maximize their returns in the long term. When considering how to maximize potential growth for your funds, building a better budget can be essential.

What Is a Money Market Account?

A money market account (MMA) is a type of savings account offered by banks and credit unions that typically comes with a higher interest rate compared to regular savings accounts. MMAs are often considered the middle ground between checking and savings accounts, providing both the benefits of earning interest and the convenience of check-writing and debit card usage.

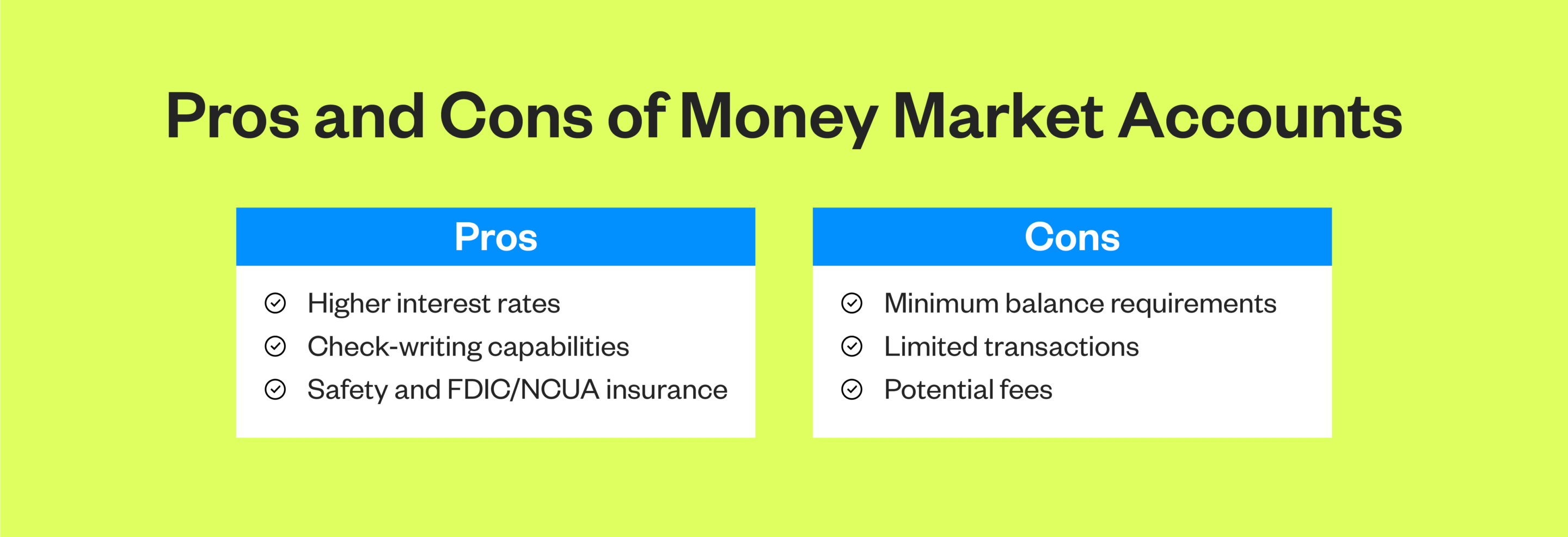

Pros of money market accounts

Money market accounts offer a unique blend of features that cater to everyday accessibility and earning potential. Pros of these saving vehicles include:

- Higher interest rates: Banks and credit unions invest money market account funds in low-risk, short-term investments, which allows them to offer higher interest rates. Account holders can expect to see their savings grow at a faster rate, making MMAs an attractive option.

- Check-writing capabilities: Account holders can directly pay from their MMA, bridging the gap between a checking and savings account. This feature provides an additional layer of flexibility that a savings account doesn't.

- Safety and FDIC/NCUA insurance: Just like with savings accounts, MMAs in banks are insured by the FDIC. Similarly, one of the benefits of a credit union is that your deposits are insured by the NCUA. This protection ensures that the funds are safe and secure, even in the unlikely event of a bank or credit union's instability.

Cons of money market accounts

A few potential drawbacks of these accounts include:

- Minimum balance requirements: Financial institutions often require a minimum balance to ensure they have a consistent pool of funds to invest. This requirement, however, can be burdensome for some account holders.

- Limited transactions: MMAs usually come with a limit on the number of certain types of monthly transactions account holders can complete. Exceeding this limit can result in additional fees, account closure or conversion of the account to a different type.

- Potential fees: Apart from the possible charges tied to minimum balance requirements or exceeding transaction limits, some MMAs might have monthly maintenance fees, especially if they offer additional services or perks.

What Is the Difference Between a Money Market Account vs. Savings Account?

MMAs and traditional savings accounts are similar in some ways and distinct in others. Knowing their differences can help you determine which option is best for you based on your unique financial situation and preferences.

Interest rates

Comparing a savings account vs. money market account, MMAs have higher interest rates compared to traditional savings accounts. On the other hand, savings accounts generally offer lower interest rates because they're primarily designed to be a safe place to store money while earning a modest interest.

Accessibility and transactions

One important question to ask is how often you need access to your money. Savings accounts and money market accounts are both subject to federal restrictions that limit the number of transactions you can make per month. However, money market accounts combine features of checking and savings accounts and come with check-writing privileges and sometimes a debit card.

Account requirements

Money market accounts often have higher minimum balance requirements compared to savings accounts. Both types of accounts can also come with other fees like maintenance fees, though these are typically waived for savings accounts with either a minimum balance or regular monthly deposits.

Key Takeaways: Choosing Between a Money Market Account vs. Savings Account

The decision between a money market account vs. a savings account should factor in one's unique financial situation and goals. Those seeking higher growth might lean toward MMAs, while those looking for a simple place to secure their money might opt for traditional savings accounts. Become a credit union member today to learn more about our options.