Understanding Credit Scores: What Is a FICO Score?

Your credit score helps lenders assess your eligibility for various financial products, whether you're applying for a mortgage, auto loan, credit card or even renting a home. While several credit score models exist, the FICO score is one of the most widely used and trusted metrics.

What Is a FICO Score?

A FICO score is a credit scoring model that was developed by the Fair Isaac Corporation, commonly known as FICO. This credit score is a representation of your creditworthiness, which helps lenders assess how likely you are to repay borrowed money. FICO credit scores are widely used to help lenders make lending decisions, with nearly 90% of lending decisions relying on FICO scores.

Your FICO score is determined by the details found in your credit reports, encompassing your credit history and current financial standing. Scores typically span from 300 to 850, with higher scores indicating stronger creditworthiness.

What Are the Different Types of FICO Scores?

While FICO scores all provide information about a borrower's creditworthiness, there are several different types lenders may use. The core FICO score is a baseline for predicting creditworthiness across various types of loans.

FICO has developed specialized versions for specific industries. Auto lenders often use FICO Auto Scores, which factor in nuances specific to auto financing. Similarly, credit card issuers may rely on FICO Bankcard Scores to assess credit card applications.

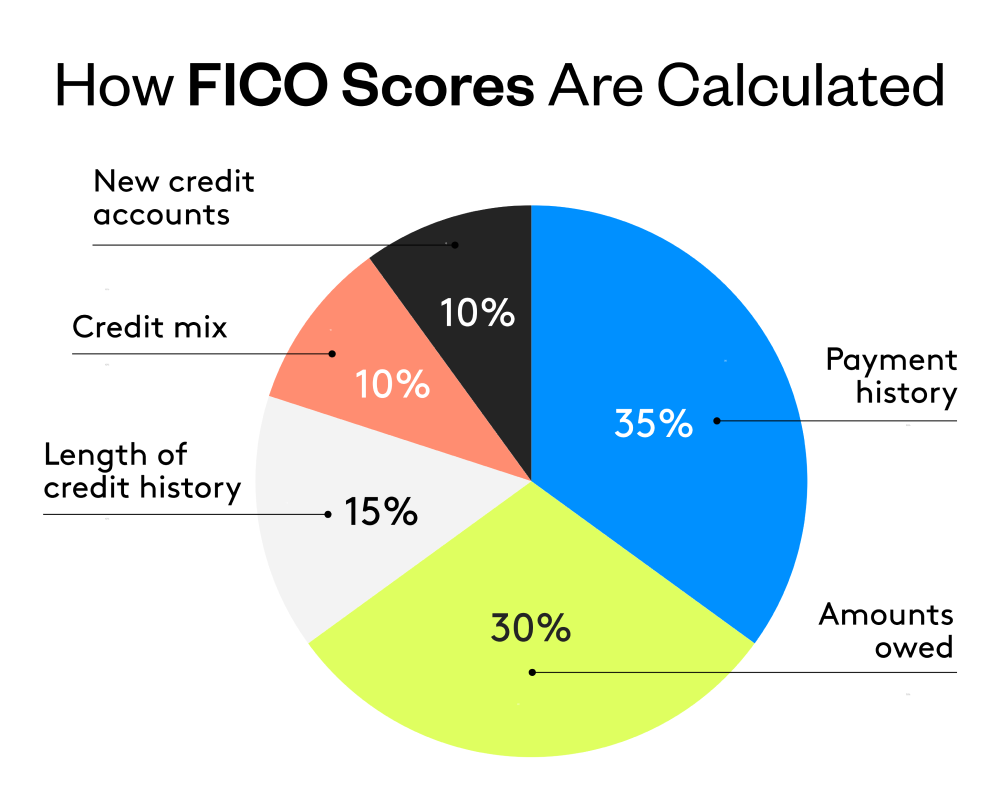

How Are FICO Scores Calculated?

FICO scores are based on five key categories of data, each weighted differently to reflect its importance in predicting your credit behavior:

- Payment history (35%): Your payment history assesses how consistently you've made timely payments across all your credit accounts. Instances of late payments, defaults or collections can negatively impact your score

- Amounts owed (credit utilization) (30%): Credit utilization refers to the balance you owe compared to your credit limit. This factor assesses the percentage of available credit in use, known as the credit utilization ratio. Higher ratios imply greater risk, while lower ratios demonstrate prudent credit management

- Length of credit history (15%): This factor examines how long your credit accounts have existed, encompassing the average age of all accounts. A lengthier credit history typically correlates with a higher score, provided all other factors remain consistent

- Credit mix (10%): Your credit mix includes a variety of different types of credit, such as personal, car, and student loans, credit cards, mortgages and retail accounts. A diverse mix can potentially enhance your score, indicating your ability to responsibly manage different forms of credit

- New credit accounts (10%): This category considers the impact of recently opened accounts and recent credit inquiries. Opening several accounts within a short timeframe may suggest increased risk, particularly for individuals with limited credit histories

What Is a Good FICO Score?

Your FICO score influences your eligibility for loans and the interest rates for which you qualify. It can even impact decisions such as renting apartments or obtaining insurance. Generally, the higher the FICO score the better, with scores between 670 and 739 rated as “good.” Lenders rely on this number to evaluate the risk of lending to you, so it's necessary to understand where your score falls within the creditworthiness spectrum.

FICO Score Ranges

- <580: Poor: A FICO score below 580 is considered poor and indicates a higher risk of defaulting on loans. Individuals in this range may find it challenging to secure credit or loans

- 580-669: Fair: While not ideal, this range suggests a moderate level of risk to lenders. Individuals with these scores may qualify for credit cards and loans, though with higher interest rates than those with higher scores

- 670-739: Good: A good FICO score reflects responsible credit management and demonstrates to lenders that you'll likely repay debts on time. Borrowers in this range typically qualify for competitive interest rates and good terms on loans

- 740-799: Very good: Lenders view individuals in this category as low-risk borrowers. They typically qualify for some of the best interest rates and terms on loans, mortgages, and credit cards, making obtaining credit at favorable terms easier

- 800+: Exceptional: An exceptional FICO score places you among the most creditworthy consumers. Lenders consider individuals in this range highly unlikely to default on loans. Borrowers with these scores typically receive the best offers on credit products, including the lowest interest rates and most favorable terms available

How Can You Improve Your FICO Credit Score?

Improving your FICO credit score can help you qualify for credit and secure better terms with lower interest rates, whether taking out a new loan or refinancing an existing one.

- Make timely payments: Since payment history constitutes 35% of your score, consistently making timely payments on all your credit accounts shows responsible financial behavior and can improve your score

- Reduce credit card balances: Credit utilization accounts for 30% of your FICO credit score. Lowering your balances shows lenders that you can manage credit responsibly

- Limit credit inquiries: Each application for new credit triggers a hard inquiry on your credit report, potentially lowering your score temporarily. To lessen this impact, apply for credit only when needed and spread out your applications over time

- Maintain a variety of credit types: Having a diverse mix of credit can enhance your FICO score. Lenders need to see that you can responsibly manage different forms of credit, showcasing your capability to handle various financial obligations

- Keep old accounts open: The length of your credit history contributes to 15% of your FICO score. Keeping old, well-managed accounts open shows a longer credit history

Why Is Your FICO Score Important?

- Impact on loan approval and interest rates: The higher your FICO score, the better your odds of loan approval for mortgages, auto loans, personal loans and credit cards. Lenders use your score to assess your creditworthiness and figure out the interest rates they offer you. A higher credit score often means you can get lower rates, which is one of the best ways to save money over the life of the loan

- Rental applications: Landlords and property management companies often check your credit score as part of the rental application process. A higher score can make you a more attractive tenant, as it can indicate you can responsibly make your rental payments on time, potentially leading to easier approval and better rental terms

- Employment opportunities: Certain employers perform credit checks during the hiring process, especially for roles involving financial duties or access to sensitive information

How Can You Check Your FICO Score?

You can check your FICO score through several methods to stay informed about your credit health. One common way is by requesting your free annual credit report from any one of the three major credit reporting bureaus: Equifax, Experian or TransUnion. Each bureau is required to provide you with a free credit report once a year upon request, which includes your FICO score. You can request these reports through AnnualCreditReport.com, the authorized website for free credit reports under federal law.

Additionally, many banks and credit unions offer free access to a credit score model through their online banking platforms or mobile apps.

Wrapping Up: Understanding FICO Scores

Understanding your FICO score can help you manage your finances and secure more favorable terms on loans, credit cards and other financial products. Lenders widely use this score, with higher scores indicating lower risk and potentially lower interest rates.

Monitoring your FICO score regularly is essential for those looking to improve their credit score or understand their current financial standing. California Credit Union offers resources and financial counseling to improve your financial literacy and help you understand your credit. Whether you want to boost your score or maintain a healthy credit profile, we're committed to giving you the knowledge and tools needed for financial success.