Refinancing Loans: What Is Refinancing?

The weight of loans can sometimes feel overwhelming. However, there's a financial strategy that can alleviate some of this burden — refinancing. As you navigate the various types of loans, you might discover that refinancing is not a one-size-fits-all solution but rather a spectrum of possibilities tailored to specific needs.

This financial move opens doors to various types of refinancing, each offering unique advantages that can make a substantial difference in managing debt. Whether seeking lower interest rates, extended repayment terms, or other financial perks, understanding refinancing can help you improve your financial literacy while achieving greater financial flexibility and peace of mind.

But what is refinancing, and how does it work? If you have loans or are considering taking one out, keep reading to learn more about refinancing and how it can help alleviate some financial stress associated with borrowing money.

What Is Refinancing?

Refinancing (refi) is a financial strategy that involves replacing an existing loan with a new one, typically with more favorable terms. The primary goal of refinancing is to secure better terms, which may include lower interest rates, extended repayment periods, or a change in the type of loan. This process is not exclusive to any specific type of loan but is commonly associated with mortgages, auto loans and student loans, allowing you to create a budget that makes sense based on your unique circumstances.

When someone refinances a loan, they pay off the existing debt with the proceeds from the new loan, resulting in several potential advantages. The most common reason for refinancing is when someone is looking for ways to save. They might want to obtain a lower interest rate, leading to reduced monthly payments and, ultimately, overall cost savings.

But what is refinancing a home? When someone refinances a home, they may choose to either lower their interest rate, increase their repayment period, or change the type of mortgage. They might also refinance their mortgage to tap into home equity, converting into cash for various purposes. Mortgage refinancing options differ from auto loan refinancing and other loan refinancing options, so learning as much as possible about your particular loan and refinancing options is crucial.

What Are The Different Types of Refinances?

Refinancing is a versatile financial tool that comes in various forms, catering to the diverse needs and goals of borrowers. Among the array of refinancing options, some stand out for their specific benefits and applications:

- Rate and term refinance: A rate and term refinance is a common choice for those aiming to secure better interest rates or alter the loan's duration.

- Cash-in refinance: A cash-in refinance involves the borrower making a significant upfront payment, effectively reducing the loan amount and potentially qualifying for improved terms.

- Cash-out refinance: A cash-out refinance allows homeowners to convert a portion of their home equity into cash, providing liquidity for anything from home improvements to debt consolidation and more.

- Consolidate refinance: A consolidate refinance merges multiple loans into a single, more manageable debt, simplifying payments and potentially securing more favorable terms.

What Types of Loans Can You Refinance?

While refinances are often discussed in a mortgage context, there are various other loans you can refinance to improve your financial health and flexibility. Among the diverse spectrum of loans, several types are typically eligible for refinancing, such as:

- Mortgage refinancing: A mortgage loan can be refinanced to secure more favorable terms, such as lower interest rates or adjusted repayment periods. A cash-out refinance also allows homeowners to tap into their built-up equity and take cash out of their homes.

- Auto loan refinancing: If you have an auto loan, refinancing allows you to potentially reduce monthly payments or obtain a better interest rate by replacing the existing loan with a new one.

- Student loan refinancing: For those grappling with student debt, student loan refinancing offers the prospect of consolidating loans into a single, more manageable obligation with adjusted terms.

- Credit card refinancing: If you have debt from credit cards, you might consider consolidating your debt into a single loan. Although less common, credit card refinancing can be pursued to consolidate high-interest credit card debt into a single, more affordable loan, allowing you to pay off credit card debt faster.

How Does Refinancing Work?

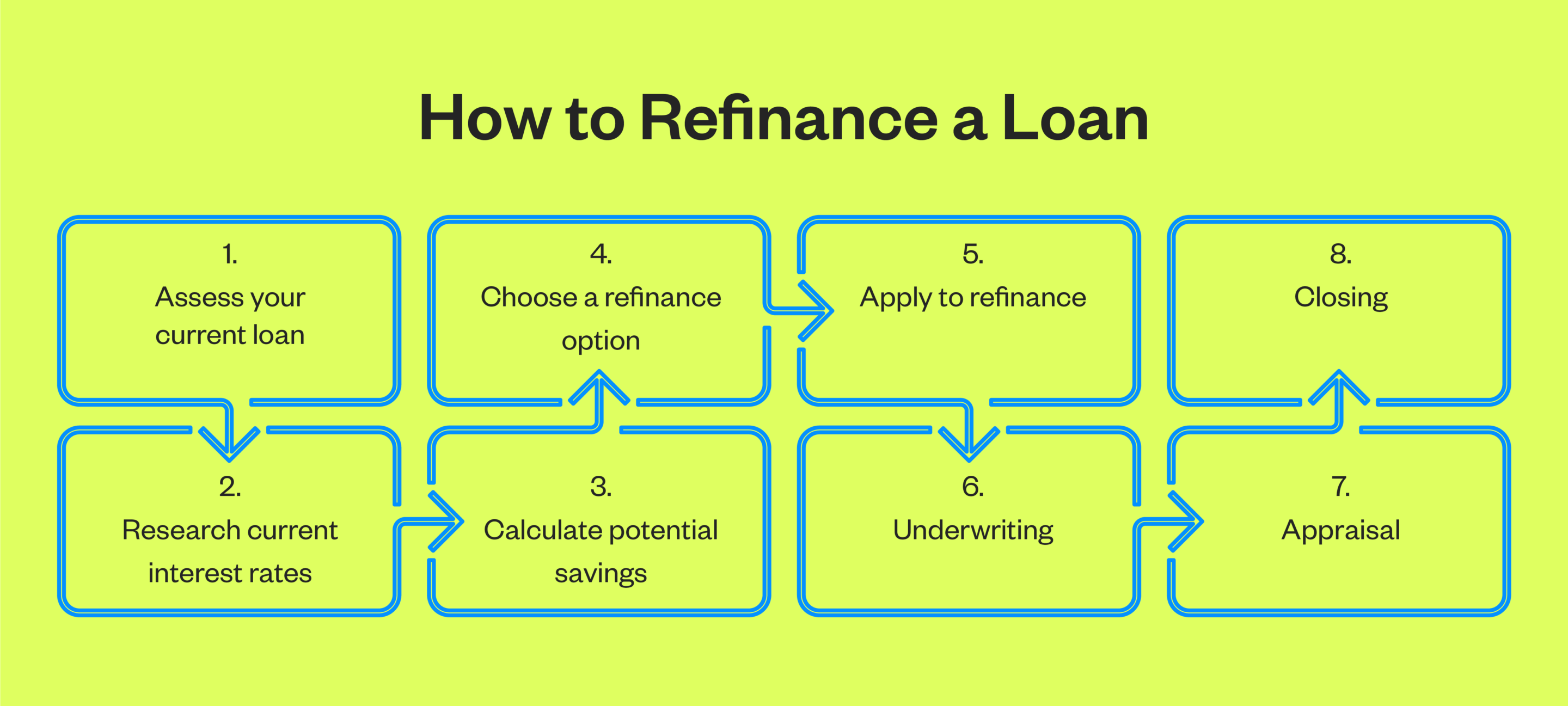

Refinancing a loan isn't as complicated as it might sound. It involves a process of working with your lender to assess your current loan, understand its terms, interest rates and overall financial impact, and make the best choice for you. So, how does refinancing work? Here's the general process:

- Assess your current loan: Thoroughly examine your existing loan to understand its terms, interest rates and any associated fees.

- Research current interest rates: Investigate current interest rates to compare against your loan's interest rate. Lower interest rates are typically a driving factor in the decision to refinance a loan.

- Calculate potential savings: With the information gathered in the first two steps, calculate the potential savings that could result from loan refinancing. Consider the reduction in interest rates and changes in loan duration or monthly payments.

- Choose a refinance option: There are various types of loan refinancing, each catering to specific needs. Whether it's a rate and term refinance for lower interest rates or a cash-out refinance to access home equity, understanding each option is crucial. Choose the type that aligns best with your situation and financial goals.

- Apply to refinance: Once you've made a decision, you can complete the application with the lender. Prepare the necessary documentation, such as proof of income and credit history.

- Underwriting: The application will undergo a thorough review to determine your eligibility based on creditworthiness and the terms you qualify for.

- Appraisal: If you're refinancing a home loan, an appraisal of the property is typically required to determine its fair market value. The lender will assess the current value of your home to ensure the loan amount accurately reflects the home's value.

- Closing: The final step involves closing the refinanced loan. During this stage, you'll sign the necessary documents, and the funds from the new loan will be used to pay off the existing one.

What Are the Benefits of Refinancing?

Loan refinancing offers a range of potential benefits tailored to meet the unique needs and goals of borrowers. Some key advantages include the following:

- Receive new loan terms: New loan terms provide a chance to recalibrate the financial arrangement to better suit your current situation.

- Lower your interest rate: Lowering the interest rate can lead to significant savings over the life of the loan, reducing the overall financial burden.

- Change loan types: Shifting loan types, potentially from adjustable-rate to fixed-rate mortgages or vice versa, allows homeowners to ensure they have the right loan based on their needs.

- Debt consolidation: By merging multiple loans into a single, more manageable obligation, you can streamline payments and potentially lower overall interest rates.

What Are Challenges and Considerations With Refinancing?

While loan refinancing can bring about numerous advantages, it's crucial to approach the process with a clear understanding of the potential challenges and considerations involved.

- Closing costs: If you're refinancing a mortgage, you should be aware of closing costs, which can include fees for application, appraisal and other administrative expenses.

- Credit score impact: The application and approval process for loan refinancing can lead to a temporary dip in your credit score. However, your score can strengthen with regular, on-time bill payments.

- Market volatility: Interest rates can fluctuate, potentially influencing the benefits of refinancing. If you switch from a fixed-rate loan to an adjustable-rate loan, your loan costs may increase above what they were.

What Are Tips for Refinancing?

While refinancing a loan is a fairly easy process, ensuring it aligns with your financial goals and results in favorable outcomes is crucial. Follow these tips to ensure your refinancing strategy can contribute to a more successful result:

- Monitor your credit score: Building good credit often translates into better interest rates and more favorable loan terms.

- Review loan terms: Reviewing the loan terms allows you to understand interest rates, repayment periods and any associated fees, providing a clear baseline for evaluating the potential benefits of refinancing.

- Seek professional advice: Whether from financial advisors or mortgage experts, financial counseling can offer valuable insights and guidance throughout the refinancing process.

- Stay updated on market trends: Interest rates can fluctuate, impacting the overall feasibility of refinancing. Staying up to date on the market can help you avoid potentially higher rates.

- Understand your debt-to-income ratio: Your debt-to-income (DTI) ratio represents the amount of income that goes toward paying your monthly debts. Knowing this ratio can help you determine whether you qualify for a particular type of loan or refinance.

Wrapping Up: What Is Refinancing?

Refinancing can provide relief from the burdens of loans, offering a spectrum of possibilities tailored to individual needs. Whether it's obtaining lower interest rates, extending repayment terms or consolidating debt, understanding refinancing is crucial for achieving greater financial flexibility. If you're considering refinancing, you should carefully weigh the benefits and challenges.

At California and North Island Credit Union, we understand the importance of financial well-being, and our team is here to help you explore refinancing options that align with your goals. Become a member or visit one of our local branches today to get started.

All loans subject to approval. Terms, conditions and fees may apply. Equal Housing Opportunity. NMLS #401403.