What Is a Business Line of Credit & How Does It Work?

Business lines of credit are flexible financial tools that provide a revolving credit limit to businesses, allowing them to borrow funds up to a certain amount as needed.

As a business owner, you know that fluctuations in cash flow are common. Whether it’s covering unexpected expenses, investing in growth opportunities or managing seasonal fluctuations, having access to timely funding is crucial for sustaining and expanding operations.

This is where business lines of credit can come in handy. Acting as a safety net for financial uncertainties, a business line of credit offers a flexible solution for accessing funds when needed without the constraints of a traditional loan.

What Is a Business Line of Credit?

A business line of credit is a financial arrangement between a business and a lender that provides the business with access to a predetermined amount of funds up to a specified credit limit. Unlike a business term loan, where the borrower receives a lump sum of money upfront and repays it over a fixed period with regular payments, a business line of credit operates more like a credit card for businesses.

There are limits set by the lender on how much can be borrowed through the business line of credit. These limits are determined based on factors like the creditworthiness of the business, its financial history and its ability to repay the debt.

Wondering if a loan or line of credit is best for your business? Try our line of credit calculator.

How Does a Business Line of Credit Work?

Lines of credit for business can be used to manage cash flow, cover expenses and seize opportunities for growth. Here are a few key features to help you understand how they work:

- Secured or unsecured options: Secured lines of credit require collateral, such as business assets, accounts receivable or real estate, to back the credit line, providing added security for the lender. On the other hand, unsecured lines of credit don’t require collateral but may have stricter qualification criteria and higher interest rates

- Revolving credit: Payments are made on a revolving basis, meaning that as payments are made, the available credit replenishes, allowing for ongoing access to funds without the need to reapply for a new loan each time

- Flexibility: With a business line of credit, the borrower can withdraw funds as needed, up to the approved credit limit. You can also use the funds for any business purposes, from covering

- Interest: Interest is incurred only on the amount of funds borrowed from the business line of credit. If you don’t use the full credit line, you’re not obligated to pay interest on the unused portion

- Fees: Potential fees may include origination fees charged when the line of credit is established, maintenance fees for keeping the line of credit open, annual fees assessed on an annual basis, draw fees for accessing funds and late fees for missed payments

- Term: A business line of credit may be open ended but is more typically associated with a renewal period from 1 to 5 years. Financial reviews are typically completed on an annual basis

- Ongoing Requirements: Business lines of credit often have covenants that must be met in order for the line to remain active. One common covenant requires that a business line of credit must rest the line at a zero balance for 30 days within a 12-month period. Additional covenants may include financial requirements, and/or a credit review

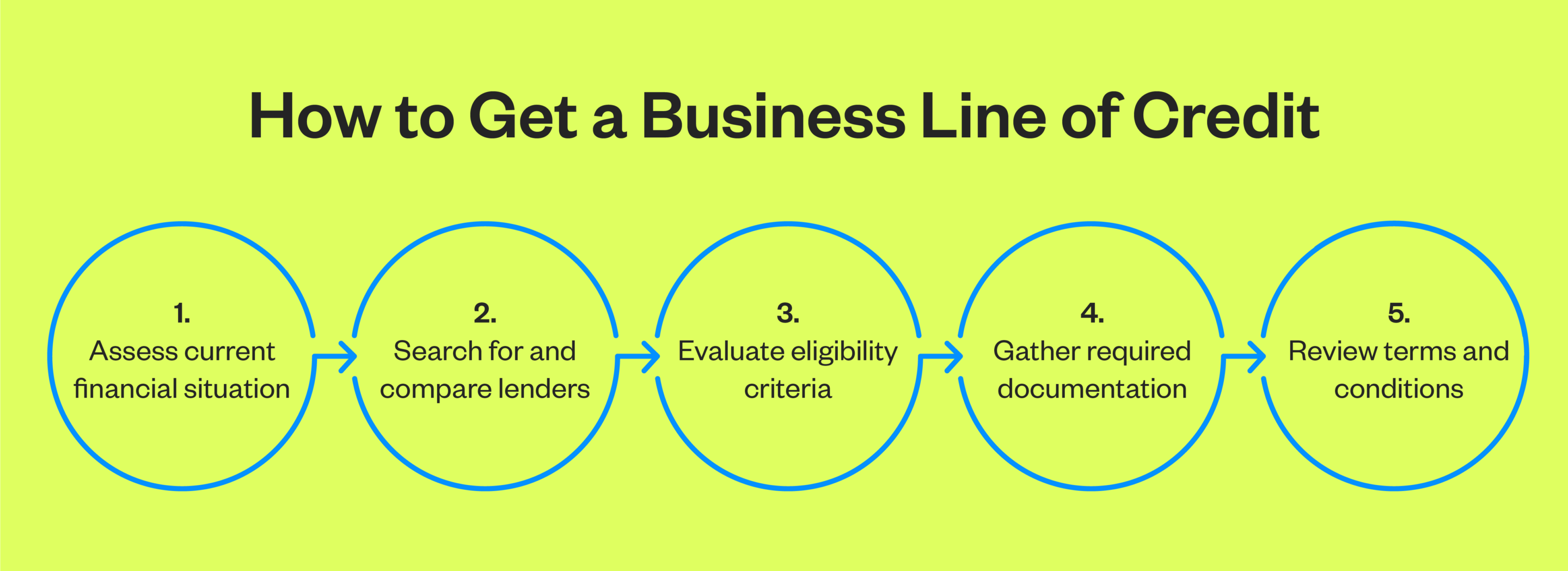

How Do You Get a Business Line of Credit?

Getting a line of credit for a business involves several steps to ensure that you find the right lender and secure favorable terms for your needs. Here’s how to get a business line of credit:

- Assess current financial situation: Review financial statements, cash flow projections and credit history to determine the amount of credit needed and your business’s ability to repay it

- Search for and compare lenders: Research different credit unions or banks, online lenders or alternative lending platforms to find the best fit for the business’s needs. When comparing lenders, consider factors like interest rates, repayment terms, banker relationship and fees associated with each lender

- Evaluate eligibility criteria: After narrowing down potential lenders, evaluate eligibility criteria for each lender. This may include factors such as your business’s credit score, revenue history, time in operation and industry

- Gather required documentation: Organize your financial statements, tax returns, entity documentation and other relevant paperwork

- Review terms and conditions: You should understand the interest rates, repayment terms, fees, guarantor liability and any other provisions associated with the line of credit

What Are the Benefits of a Business Line of Credit?

A business line of credit offers a range of benefits that can be invaluable for businesses of all sizes and industries.

- Build business credit: Using a business line of credit responsibly, making timely payments and managing credit utilization can help businesses build good credit and improve their credit profile

- Manage cash flow: A business line of credit provides a flexible source of funding that can be tapped into as needed to cover everything from day-to-day expenses to unexpected costs

- Mitigate seasonal fluctuations: Businesses in industries with seasonal demand may benefit from a business line of credit to navigate periods of low revenue

- Flexibility: A business line of credit is versatile. The funds can be used for a wide range of purposes, including purchasing inventory, financing marketing initiatives, investing in equipment, covering payroll or addressing emergency expenses

Wrapping Up: Business Lines of Credit

Business lines of credit give businesses the flexibility and financial security they need to navigate uncertainties, seize opportunities and achieve their long-term objectives. Whether you’re managing cash flow, covering unexpected expenses or investing in growth opportunities, a business line of credit can provide a versatile financing solution tailored to your needs.

At California Credit Union, we understand the unique challenges businesses face and offer business lines of credit with competitive rates, personalized service and a focus on supporting our local communities. Contact us today to learn more about our business lines of credit and how we can help your business succeed.