How to Switch Banks: Step-by-Step Guide to Moving from a Bank to a Credit Union

Your Step-by-Step Guide To Switching Banks

If you're unhappy with your current bank's fees, customer service or lack of competitive rates, you're not alone. Many people are discovering that switching banks can lead to better finances and a more personalized banking experience.

Learning how to switch banks might seem complicated at first, but with proper planning, you can transition smoothly to a new financial institution that better serves your needs.

In this article, you'll discover the common reasons people switch, the advantages of moving to a credit union and a step-by-step process for making the transition without missing a beat.

Key Takeaways

- Switching banks is simple, and the timing depends on how quickly you update your automatic payments and deposits. Many members complete the process in just a few days.

- You'll need to maintain your old account temporarily while transitioning automatic payments and direct deposits

- Switching banks doesn't directly affect your credit score, though opening certain new accounts might.

- Proper planning helps you avoid missed payments and unnecessary fees during the transition.

Common Reasons for Switching Banks

People decide to change banks for various reasons, and understanding your motivation can help you choose a better financial institution the second time around.

- Convenience: If your bank has closed nearby branches, reduced hours or doesn't offer the digital features you need, it can create unnecessary hassle in managing your money. Modern banking should fit your lifestyle with intuitive mobile apps and accessible branch locations

- Customer service: Poor customer service, long wait times and unhelpful representatives make simple banking tasks frustrating. When you need help with your finances, you deserve responsive, knowledgeable support

- Security: Recent data breaches or fraud incidents can shake your confidence in a bank's ability to protect your money. Adequate fraud protection and monitoring tools are essential for peace of mind

- Better rates and fees: High monthly maintenance fees, ATM charges, overdraft penalties and low interest rates can cost you over time

Advantages of Switching from a Bank to a Credit Union

When people switch from a bank to a credit union, they often discover benefits they didn't know were possible. Credit unions are member-owned not-for-profit institutions, which fundamentally changes how they do business. The benefits of switching to a credit union include:

Lower fees

Credit unions typically charge fewer fees than traditional banks. You'll often find free checking accounts with no monthly maintenance charges, lower overdraft fees and reduced ATM surcharges.

Better rates

Credit unions can offer higher interest rates (or dividends) on savings accounts and lower rates on loans. Understanding how interest rates and compound interest work can help you appreciate the long-term impact of even small rate differences.

Personalized, community-focused service

Credit unions tend to know their members personally and take time to understand individual financial situations. The benefits of a credit union extend beyond dollars and cents to include this relationship-based approach.

Easier approvals

Credit unions often take a more holistic view when reviewing loan applications. While your FICO score still matters, credit unions may be more willing to work with members with unique financial situations.

What to Know Before Switching to a Credit Union

Before you make the switch, it's important to know how credit unions differ from traditional banks. Learning about the differences between a credit union vs. bank helps set proper expectations. Here's what you need to know before switching to a credit union:

- Membership and eligibility requirements: Credit unions often have membership requirements based on where you live, where you work or what organizations you belong to. Most people qualify for at least one credit union in their area, and membership requirements are often more flexible than they initially appear.

- Available products and services: Most credit unions typically offer all of the same products banks offer. But before you switch, confirm the credit union offers the products you're looking for

- Deposit insurance: Credit unions are backed by the National Credit Union Administration (NCUA), which provides the same $250,000 coverage per depositor as FDIC insurance at banks. Your deposits are equally protected

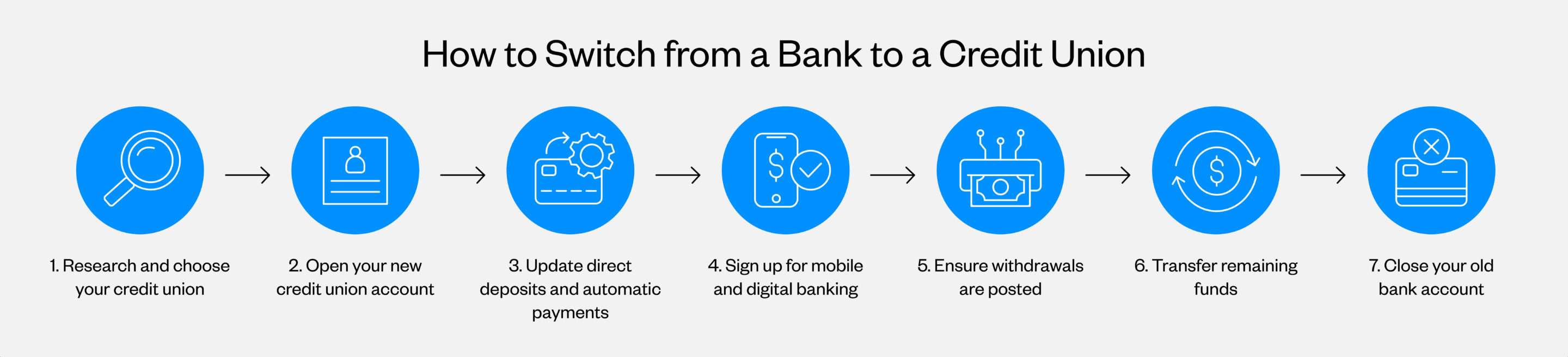

How to Switch from a Bank to a Credit Union

The smartest way to switch from a bank to a credit union is to keep both accounts open for a while instead of closing everything at once. This overlap period prevents missed payments and surprise fees while you gradually move everything over. Whether you're opening your first bank account with a credit union or have experience with both banks and credit unions, these steps will guide you through the process:

1. Research and choose your credit union

Compare credit unions near you to find the best fit for your needs. Look at interest rates, fee schedules, branch and ATM locations, mobile banking capabilities and customer reviews. Consider what matters most to you. Are you looking for better interest rates and ways to save more money, convenient branch locations or advanced mobile banking features?

2. Open your new credit union account

Many credit unions will allow you to start the application online. Before you start, gather the required documentation, which typically includes:

- A government-issued photo ID

- Your Social Security number

- Proof of address

You'll also need to have the funds for your initial deposit.

3. Update direct deposits and automatic payments

List all recurring deposits, like your paycheck, Social Security benefits and tax refunds. Contact each payer to update your banking information.

Next, inventory all automatic payments, such as rent, utilities, insurance, subscriptions and loan payments. Rather than switching everything at once, you can transition items gradually over several weeks to avoid missed payments.

4. Sign up for mobile and digital banking

Building financial literacy includes knowing how to use mobile banking tools. Download your credit union's mobile app and register for online banking as soon as your account opens. These tools let you check balances, deposit checks with your phone, transfer money and monitor transactions from anywhere.

5. Ensure withdrawals are posted

Give your old account time for all pending transactions to clear completely. Log in to your old account and verify that everything has been posted and your balance is accurate. Closing an account while transactions are still pending can result in overdraft fees and rejected payments.

6. Transfer remaining funds

Once all pending transactions have cleared, transfer your remaining balance to your new credit union account. You can do this through an electronic transfer, by writing yourself a check or by withdrawing cash.

7. Close your old bank account

Contact your old bank to officially close your account following their specific process. Request confirmation that your bank account has been closed and the closure date for your records. Once closed, destroy any remaining checks, debit cards and ATM cards by shredding them.

Making the Switch: How to Change from a Bank to a Credit Union

Switching banks or credit unions doesn't have to be complicated, and the advantages of lower fees, better rates and personalized service make the effort worthwhile.

California Credit Union offers competitive rates, member-focused service and modern banking conveniences that make switching banks rewarding. With comprehensive checking and savings options, robust digital banking tools and a commitment to member financial wellness, California Credit Union provides the community-focused alternative to traditional banking you've been looking for.