What Are Interest Rates and How Do They Work?

What are interest rates and how do they work?

An interest rate is the cost of borrowing money or the amount you earn for saving it. When you borrow, interest is what you pay a lender. When you save, interest is what a bank or credit union pays you for keeping money in an account. Expressed as a percentage of the principal amount, you can find interest rates in various financial transactions, including decisions ranging from personal savings to loans.

A combination of factors shapes the dynamics of interest rates. These rates influence the broader economy, impacting consumer spending, business investment and the overall direction of financial markets. Understanding interest rates is crucial for individuals managing personal finances to improve their financial literacy and ensure they make the best decisions about their money.

How Interest Rates Work

When you take out a loan or borrow money, the interest rate is the percentage a lender charges to borrow money or the percentage a bank pays you for keeping money in a savings account. It's expressed as a percentage of the principal amount — the initial sum of money involved in the transaction. In borrowing, the interest rate signifies the price that a borrower pays to use funds provided by the lender. For investors and savers, it represents the return they earn.

The interest rate is a crucial component of various financial instruments and transactions, including the overall cost of credit and the profitability of investments. It's typically applied over a specific period, known as the loan or investment term, and can be structured differently.

Interest rates play a central role in shaping economic activities, impacting everything from personal loans and mortgages to business financing and the valuation of assets.

What Is the Difference Between APR vs. APY?

Annual percentage rate (APR) and annual percentage yield (APY) are both important financial metrics, but they're used in different contexts.

APR is a measure of the cost of borrowing, expressed as a yearly interest rate. It includes both the interest charged on a loan and any additional fees or costs associated with borrowing. APR combines the interest rate and most fees into one yearly number, making it easier to compare loans. This metric is commonly used for loans and credit cards to help borrowers understand the total cost of borrowing over the course of a year, making it easier to compare different loan offers.

Conversely, APY is a measure of the annualized interest earned on an investment, such as a savings account or other interest-bearing accounts. It considers a process called "compounding," which reflects both the stated interest rate and how often that interest is compounded. APY is relevant for savings accounts, share certificates and other investments. It gives savers a more accurate understanding of how much their money will grow over time.

Why Is it Important to Understand Interest Rates?

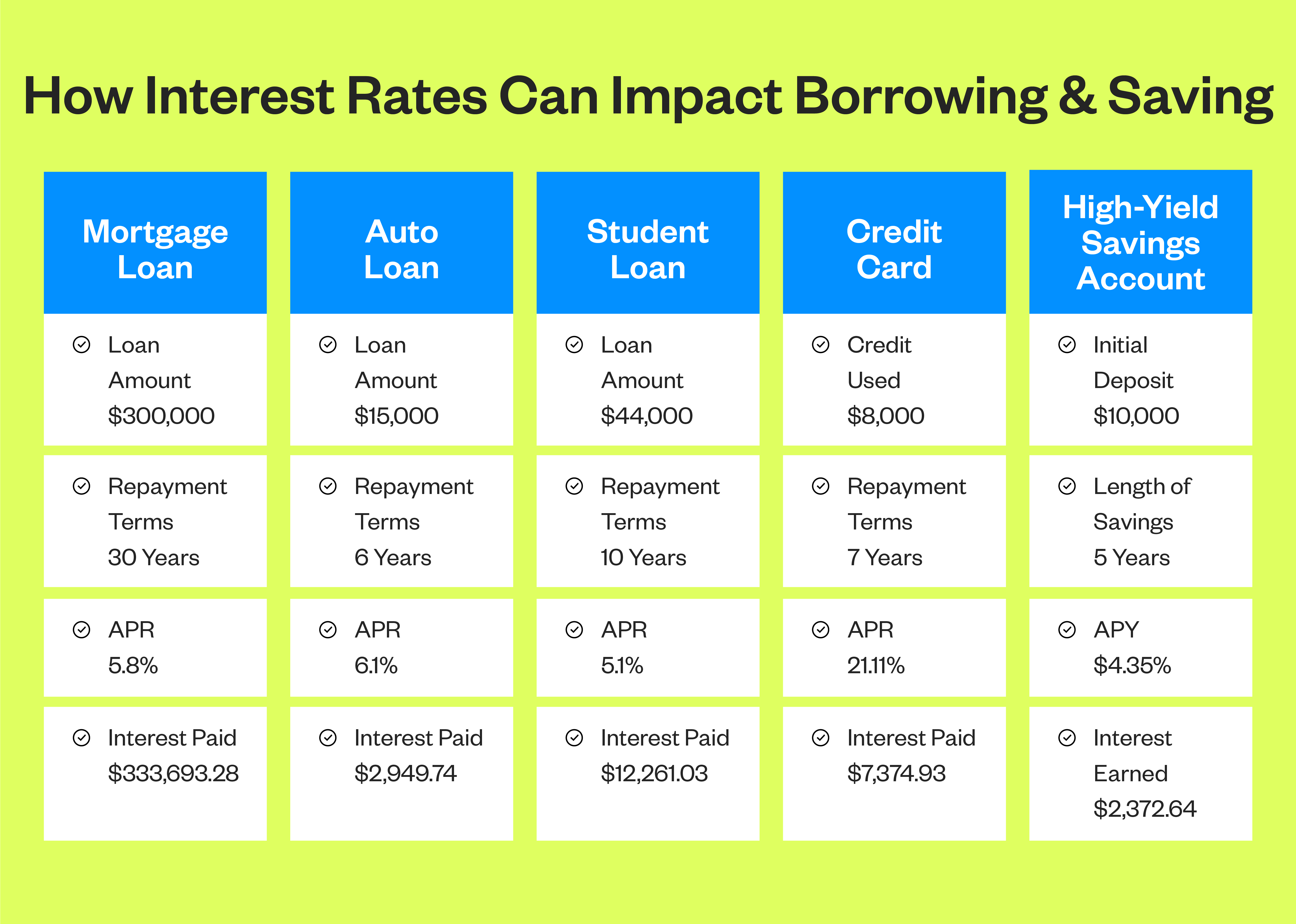

Understanding interest rates helps you know how much borrowing will really cost—and how much your savings can grow. In borrowing, interest rates tell you the cost of credit. When interest rates are higher, the cost of borrowing increases. Borrowers pay more in interest over the life of a loan, affecting the affordability of mortgages, auto loans and other forms of credit. This is especially crucial if you're creating a budget and want to know how various loans may affect your spending habits.

When it comes to saving, higher interest rates mean a greater return on investments. This is particularly important for savings accounts and share certificates. High interest rates, especially when compounded, contribute to the growth of savings over time. This is beneficial for individuals saving for long-term goals, such as retirement or education.

Which Accounts Have Interest Rates

Again, interest rates impact the cost of borrowing and the return on investments. Understanding how it's applied across different types of accounts is crucial for individuals managing their finances. From securing a home through a mortgage to building savings in a bank account, each financial instrument comes with its own interest rate dynamics.

- Mortgage loans: Mortgage loans typically involve long-term commitments, commonly spanning 15 to 30 years. The interest rates on mortgages can be fixed or variable. Fixed-rate home loans keep the same interest rate throughout the life of the loan. Variable-rate mortgages, on the other hand, can fluctuate based on market conditions.

- Auto loans: Auto loans are used to finance the purchase of vehicles and can last anywhere from 3 to 7 years or more. The interest accrues daily and is collected monthly when payments are made. Over time, as the balance is paid, the amount of interest is reduced.

- Student loans: Student loans are designed to help finance education expenses. These loans may have fixed or variable interest rates. Interest on federal student loans often accrues while the borrower is in school and during the grace period after graduation. Private student loans may have different terms, and the interest application can vary.

- Credit cards: Credit cards allow you to make purchases on credit. Interest is applied to the remaining amount if the balance isn't paid in full by the due date. Credit card interest rates are typically higher than those for loans, running from 15% to 25% or more, making it crucial for cardholders to manage balances diligently. This can be why it's so difficult to pay off credit card debt; higher interest rates compounding monthly mean you might be in a position to constantly have to play catch up.

- Savings accounts: Savings accounts offer a way for individuals to earn interest on their deposits. The interest is usually compounded regularly and added to the account balance. While savings account interest rates are generally lower than those on loans, they provide a safe and accessible means of growing your money over time.

What Factors Determine Interest Rates?

Interest rates are influenced by many factors that collectively shape the financial environment. From macroeconomic indicators to the credit history of an individual, various elements play a crucial role in determining the cost of borrowing and the return on investments.

Inflation

Inflation is the rate at which prices for goods and services increase, and it dramatically influences interest rates. The goal is to maintain stable inflation levels to foster economic growth. When inflation is high, interest rates will be higher to curb spending. Conversely, during periods of low inflation, interest rates are typically lower to stimulate borrowing and economic activity.

Credit History

It's crucial to build good credit before taking out a loan. An individual's credit history is a key factor influencing the interest rates they're offered. A higher credit score means a lower risk for the lender, resulting in lower interest rates for borrowers. Conversely, individuals with lower credit scores may face higher interest rates to compensate for the perceived risk.

Central Bank Policies

The Federal Reserve, the central bank of the United States, plays a crucial role in shaping interest rates. The Federal Reserve influences interest rates by raising or lowering key rates that banks use to borrow money.

The federal funds rate is the interest rate at which banks lend to each other overnight, impacting short-term interest rates. The federal discount rate is the interest the Fed charges banks to borrow from the Federal Reserve. The Federal Reserve can control the money supply, inflation and economic growth by adjusting these rates. In times of economic expansion, the Fed may raise rates to curb spending, while in economic downturns, it may lower rates to stimulate activity.

Loan Type

Different types of loans come with different risk profiles, impacting the interest rates assigned to them. For instance, mortgages are secured by real estate and often have lower interest rates compared to unsecured loans like credit cards. The loan's duration, whether a fixed-rate or variable-rate loan, and the purpose of the loan all contribute to the determination of interest rates.

Wrapping Up: What Are Interest Rates?

Interest rates shape the financial landscape and should always play an important role in your financial decision-making. Whether securing a loan, managing credit, or building savings, understanding how interest rates work is essential.

Explore the benefits of a credit union with California Credit Union. At California Credit Union, we recognize how important interest rates are to your financial journey. Our commitment is to provide competitive rates, tailored solutions and personalized service to empower our members to achieve their financial goals. Whether you're looking to secure a loan, manage your credit or find ways to save, California Credit Union is here to help. Learn more with our financial counseling to help you make the best decisions with your money.