How Many Credit Cards Should I Have? A Smart Guide for Managing Credit

Discover the Right Number of Credit Cards for Your Financial Situation

There’s no single “right” number of credit cards for everyone. The best number depends on your spending habits, financial discipline and credit goals. It's a fair question that doesn't have a one-size-fits-all answer. Your wallet might feel heavy with multiple cards, or maybe you're wondering if your single credit card is enough to meet your financial goals.

The truth is that the right number of credit cards depends on your overall financial situation, spending habits and long-term goals. Some people thrive with just one card, while others benefit from having several. This guide will walk you through everything you need to know about finding that sweet spot for the mix of credit cards you have, from understanding the basics of how credit cards work to managing multiple accounts responsibly.

What Is a Credit Card and How Does It Work?

A credit card allows you to borrow money to make purchases, with the agreement that you'll pay back what you owe. When you swipe or tap your card, you're using the credit card company's money, not your own. At the end of each billing cycle (typically monthly), you'll receive a statement detailing your balance and the minimum payment due.

Knowing how to use a credit card is crucial for maintaining good financial health. Credit cards influence your overall financial profile because they directly impact your credit score through several key factors. Your payment history makes up the largest portion of your credit score calculation, so making on-time payments is essential.

Credit utilization is another crucial factor that impacts your credit score. This refers to how much of your available credit you're actually using. For example, if you have a $1,000 credit limit and you're carrying a $300 balance, your utilization rate is 30%. Keeping this percentage low, ideally under 30% and even better under 10%, helps maintain a good credit score.

Your credit history length also matters, which is why understanding the long-term impact of your credit decisions is important for anyone learning how to build good credit.

How Many Credit Cards Should I Have?

How many credit cards you should have depends on several factors unique to your situation. Your income, spending patterns, financial discipline and credit goals all play a role in determining what works best for you. There's no magic number that works for everyone, but there are some general guidelines that can help.

For beginners or those new to credit, 1-2 credit cards typically provide a good starting point. This allows you to build credit history without overwhelming yourself with multiple payments and due dates. It's easier to track your spending and develop good payment habits when you're not juggling multiple accounts.

On average, Americans have about four credit cards—but that doesn’t mean you need that many. However, this doesn't mean you need to aim for this number. Some people do perfectly well with just one card, while others benefit from having more.

As you become more comfortable managing credit and your financial situation improves, you might consider adding more cards to your wallet. Multiple cards can offer benefits like better rewards programs, backup payment options and improved credit utilization ratios. However, each additional card also requires more attention and discipline to manage effectively.

Is it Good to Have Multiple Credit Cards?

Having multiple credit cards can offer several advantages when managed responsibly:

- Improved credit utilization ratio: When you have more available credit across multiple cards but maintain the same level of spending, your overall utilization percentage decreases. This can improve your credit score since utilization makes up about 30% of your score calculation

- Maximized rewards and benefits: Different cards often excel in different categories — one might offer excellent cash back on groceries, while another provides better travel rewards. By strategically using multiple cards for different types of purchases, you can earn more rewards than you would with a single card

- More diverse credit history: Each account contributes to your credit profile, and having multiple accounts in good standing demonstrates your ability to manage various credit relationships responsibly. This diversity can strengthen your overall credit profile over time

- Backup payment options: Multiple cards provide backup options if one card is lost, stolen or temporarily unavailable. This can be valuable when traveling or making important purchases. Some people also use different cards for different purposes. You might use one for everyday expenses, another for online purchases and perhaps a third for business expenses.

What Are the Risks of Having Too Many Credit Cards?

While multiple credit cards can offer benefits, having too many can create significant challenges and risks, such as:

- Temptation to overspend: When you have access to more credit, it can be easier to make purchases beyond your means, leading to debt accumulation that becomes difficult to manage

- Complex payment management: Managing multiple due dates and payment amounts becomes increasingly complex as you add more cards. Missing just a single payment can result in late fees, penalty interest rates and negative marks on your credit report

- Accumulating fees: Each credit card typically comes with potential fees. These include annual fees, foreign transaction fees, balance transfer fees and more. These costs can add up quickly when multiplied across numerous cards

- Increased fraud risk: Having many cards can increase your exposure to fraud risk, as there are more accounts that could potentially be compromised

- Hard inquiry impact: Applying for several cards at once means potentially causing several hard inquiries on your credit report. Too many inquiries can temporarily lower your score and signal to lenders that you may be taking on too much debt.

How Can You Determine How Many Credit Cards Are Right for You?

Determining the right number of credit cards for your situation requires honest self-assessment across several areas:

- Consider your financial goals and spending patterns: Are you trying to build credit from scratch, maximize rewards or simply have a reliable payment method? Your goals should influence how many cards make sense for your situation

- Consider your current credit score and existing debt: If you're still working on improving your credit or paying down existing debt, adding more credit cards might not be the best strategy. Focus on managing what you have responsibly before expanding the mix of credit cards you have

- Assess your ability to manage multiple accounts: This includes not just making payments on time but also tracking spending across different cards, monitoring for fraudulent activity and staying organized with multiple statements and due dates. Be honest about your organizational skills and the time you have available for financial management

- Think about your lifestyle and spending patterns: If you travel frequently, cards with travel benefits might make sense. If you have consistent spending in specific categories, such as groceries or gas, cards that offer bonus rewards in those areas can be valuable

- Review your income and financial stability: Having multiple credit cards requires the discipline to avoid overspending and the income to handle multiple payments if needed. Make sure your income can comfortably support your credit obligations before adding more cards to your wallet

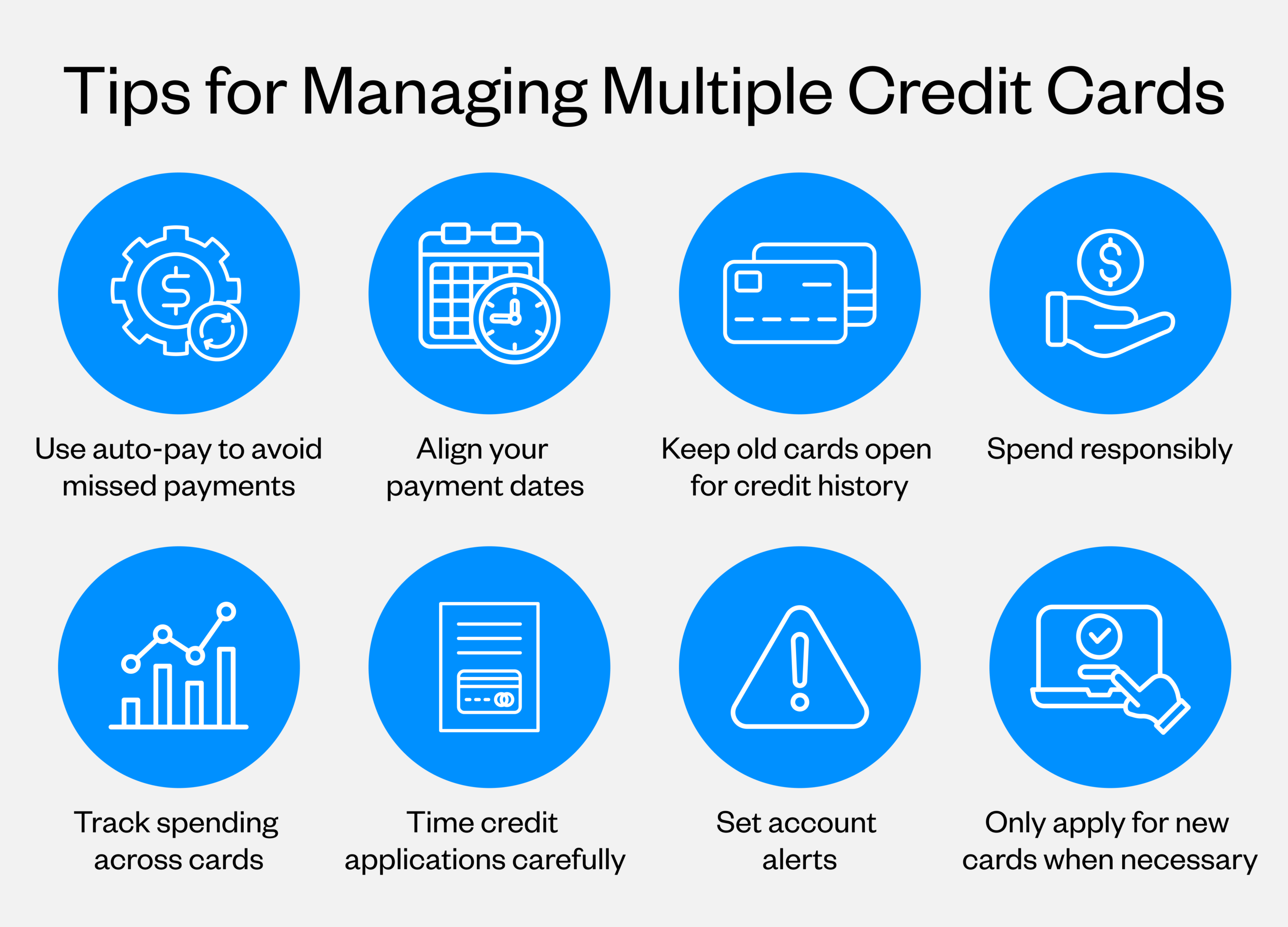

Tips for Managing Multiple Credit Cards

Successfully managing multiple credit cards requires organization, discipline and smart strategies. Here are practical approaches that can help you stay on top of multiple accounts:

- Set up automatic payments: This is one of the most effective ways to avoid missed payments across multiple cards. You can set up autopay for at least the minimum payment on each card, ensuring you never face late fees or damage to your credit score from forgotten due dates

- Align your payment dates: Setting all your cards to pay on the same date creates a single “credit card payment day” each month making it much easier to stay organized and avoid missing payments

- Keep old cards open for credit history: Keeping older cards open helps maintain your credit history length. This factor accounts for 15% of your overall score, so closing old accounts can potentially hurt your score

- Spend responsibly across all accounts: Having multiple cards doesn't mean you should spend more overall. Stick to purchases you can afford to pay off and avoid the temptation to view available credit as extra spending money

- Track spending across all cards: Use a budgeting app, spreadsheet or simple notebook to monitor your spending across different cards. This helps prevent overspending and ensures you stay within your overall budget regardless of which card you use

- Time credit applications carefully: Avoid applying for new credit cards when planning major purchases, such as a home or car. Lenders for mortgages and auto loans prefer to see stable credit profiles, and new credit applications can temporarily impact your score and debt-to-income ratio.

- Set up account alerts: Most credit card companies offer text or email alerts for activities like payments due, large purchases or when you approach your credit limit. These notifications can help you stay on top of multiple accounts without constant manual checking

- Only apply for new cards when necessary: Before applying for another credit card, honestly assess whether you can manage another account responsibly. Consider whether the benefits justify the additional complexity in your financial life

Wrapping Up: How Many Credit Cards Should You Have?

The question of how many credit cards you should have doesn't have a universal answer, but it does have a personal one that depends on your unique financial situation, goals and ability to manage credit responsibly. Whether you thrive with one card or benefit from several, the most important factor is using credit in ways that support your financial health. Remember that financial literacy isn't something you can learn overnight, and your credit needs may evolve over time.

Building and maintaining good credit is just one part of a comprehensive financial strategy that should also include creating a budget, finding ways to save and working toward your long-term financial goals. If you need guidance, consider seeking financial counseling to help you make informed decisions. At California Credit Union, we understand that managing credit is crucial for your financial success, and whether you're looking for your first credit card or ready to manage your existing credit more effectively, we're here to help you make informed decisions that support your financial goals.