Closing Cost Calculator

When you take out a mortgage loan, you pay closing costs directly to your lender to cover their costs of originating and servicing your loan. These costs cover everything from home appraisals to title searches and insurance that you’ll pay when you close on your mortgage. A closing cost calculator helps you estimate these expenses so you can budget properly and avoid surprises at the closing table.

Whether you're a first-time homebuyer or looking to refinance your mortgage, knowing how closing costs are calculated gives you the power to negotiate and plan. These fees are a significant upfront investment beyond your down payment, making it crucial to calculate closing costs early in your home buying journey.

What are closing costs?

Closing costs are the fees you pay when finalizing your mortgage loan and taking ownership of a property. These costs represent the various services and processes required to complete your home purchase, from verifying the property’s condition to ensuring clear ownership transfer.

The fees cover services provided by your lender, third-party professionals and government agencies. Your lender charges origination fees for processing your loan application and underwriting your mortgage. Third-party services include appraisals, inspections and title searches that protect both you and your lender's interests. Government fees cover the legal recording of your property ownership transfer.

How Much Are Closing Costs?

Closing costs vary by location, but you can expect to pay anywhere from 2% to 6% of your loan amount. You may be able to negotiate with the seller to pay a portion of your closing costs, but in most cases, you’ll be responsible for them. These fees don’t include your down payment, so it’s crucial to understand how much you’ll owe when signing your final loan documents.

Tips to Lower Your Closing Costs

While closing costs are largely unavoidable, there are several strategies you can use to help reduce your out-of-pocket expenses. Being proactive and doing your research can save you hundreds of dollars at closing. Follow these tips to find ways to save and reduce your closing costs:

- Shop around for lenders and escrow services: Different lenders and service providers charge varying fees, so comparing options can lead to significant savings

- Ask for lender credits: Some lenders offer credits that offset closing costs in exchange for a slightly higher interest rate

- Negotiate with the seller to cover some costs: In a buyer's market, sellers may agree to pay a portion of your closing costs to close the deal

- Explore assistance programs: First-time homebuyer programs and local housing authorities often provide closing cost assistance

- Review the Loan Estimate and Closing Disclosure for accuracy: Carefully check all fees for errors and question any charges that seem excessive or unexpected

What Should You Expect at Closing?

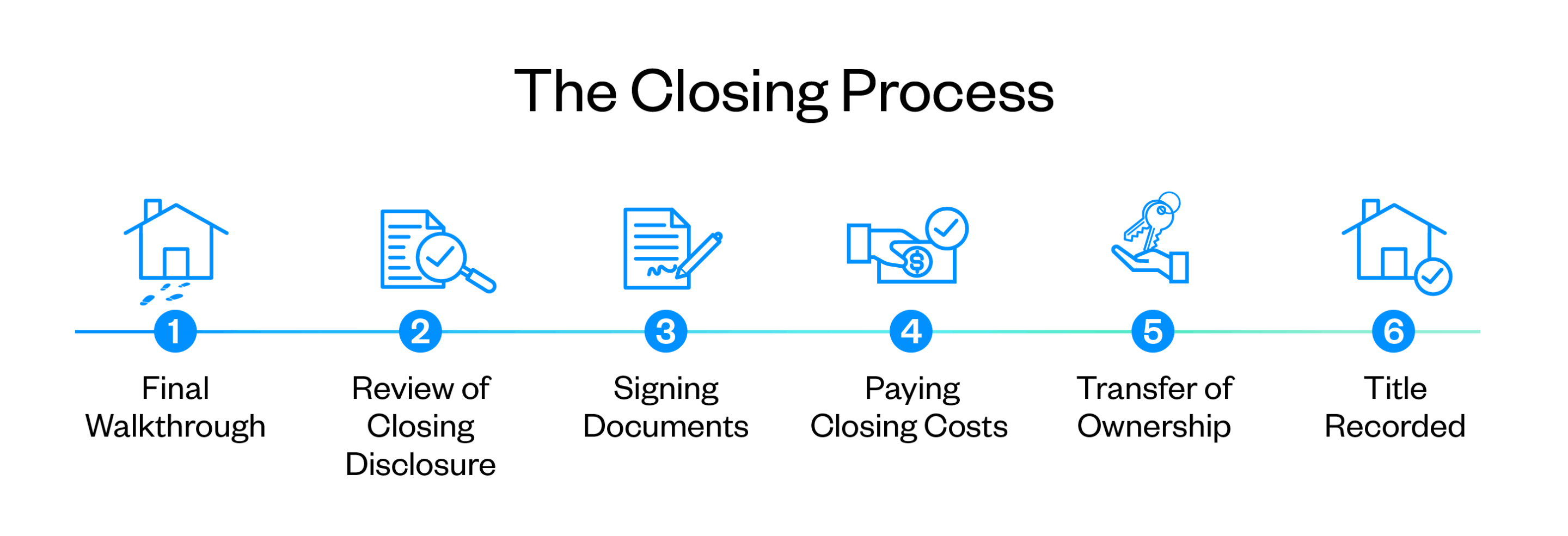

The closing process consists of several important steps that officially transfer ownership and finalize your mortgage. Understanding what happens helps you prepare and ensures a smooth transaction. Typically, the closing process follows these steps:

- Final walkthrough: You'll inspect the property one last time to ensure it's in the agreed-upon condition and any negotiated repairs were completed

- Review of Closing Disclosure: You'll receive and review your final Closing Disclosure, which details all loan terms and closing costs at least three days before closing

- Signing documents: You'll sign numerous legal documents, including your mortgage note, deed of trust and various disclosure forms

- Paying closing costs: You'll provide a cashier's check or send a wire transfer to cover your closing costs and down payment

- Transfer of ownership: The property seller will sign the deed, transferring legal ownership of the property to you

- Title recorded: Your local government office will officially record the deed and mortgage documents, making your ownership public record

Wrapping Up: How We Can Help You Afford a Home

Calculating closing costs can help you build a budget for your dream home, but they’re not the only factors to consider. Try our closing cost calculator for California to learn more about your costs, or take advantage of our financial counseling today to determine whether now is the right time to purchase a home. Consider the benefits of a credit union when choosing your mortgage lender, and remember that a good credit score can help you get better loan terms.

Once you’re ready to buy a home, you can take advantage of our mortgage offerings to find the best loan for you. If you already own a home, learn how to refinance your mortgage to potentially reduce your monthly payments.

California Credit Union cannot and does not guarantee the accuracy or the applicability to your individual circumstances. All examples are hypothetical and are for illustrative purposes. Calculator results are estimates based on information you provided and California Credit Union does not guarantee your ability to receive these terms. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.