What Is the Difference Between a Checking vs. Savings Account?

A checking account provides convenient access for everyday spending and bill payments. In contrast, a savings account focuses on growing your balance with higher interest rates and helping you build money for tomorrow's needs. Understanding the difference between a savings and a checking account can help you make smarter decisions about managing your money and reaching your financial goals at any stage of your life.

Whether you're opening your first bank account or looking for ways to save, you'll learn how these accounts work together to support your financial health.

Key Takeaways

- Checking accounts handle daily spending, while savings accounts help money grow over time

- Checking accounts offer unlimited transactions, while savings accounts typically limit monthly withdrawals

- Savings accounts generally earn higher interest or dividends than checking accounts

- Each account type has different fee requirements and minimum balance rules

- Most people benefit from having both accounts to cover immediate needs and future goals

What Is a Checking Account?

A checking account is your primary hub for managing your day-to-day finances. Financial institutions design these accounts specifically for frequent transactions, offering multiple access methods without transaction limits or penalties for regular use. This unlimited transaction structure makes checking accounts ideal for covering regular expenses, such as monthly bills, grocery shopping, dining, entertainment and emergency purchases

Checking accounts provide several essential features for money management. You receive a debit card to use at point-of-sale terminals, ATMs and online merchants, directly debiting your account balance. Meanwhile, direct deposit allows employers to transfer paychecks automatically, while online bill pay systems allow for scheduled payments for utilities, loans and subscriptions.

Modern checking accounts include digital banking features that streamline financial tasks. Mobile check deposits let you photograph and submit checks remotely, while account alerts notify you of low balances or unusual activity. Many banks or credit unions offer fee-free ATM networks, and some reimburse out-of-network ATM charges, too.

What Is a Savings Account?

A savings account is a growth-oriented repository for funds you don't need for immediate expenses. These accounts prioritize growth and savings, using higher interest rates or dividend payments to increase your balance over time.

Savings accounts earn more than checking accounts through interest rates or dividend payments. Credit unions offer competitive dividend rates to members, sometimes substantially higher than traditional bank interest rates.

Savings accounts work best for money you don't need right away. Emergency funds can grow safely while staying available when you actually need them. You can save for vacations, car down payments or home repairs without worrying about accidentally spending the money.

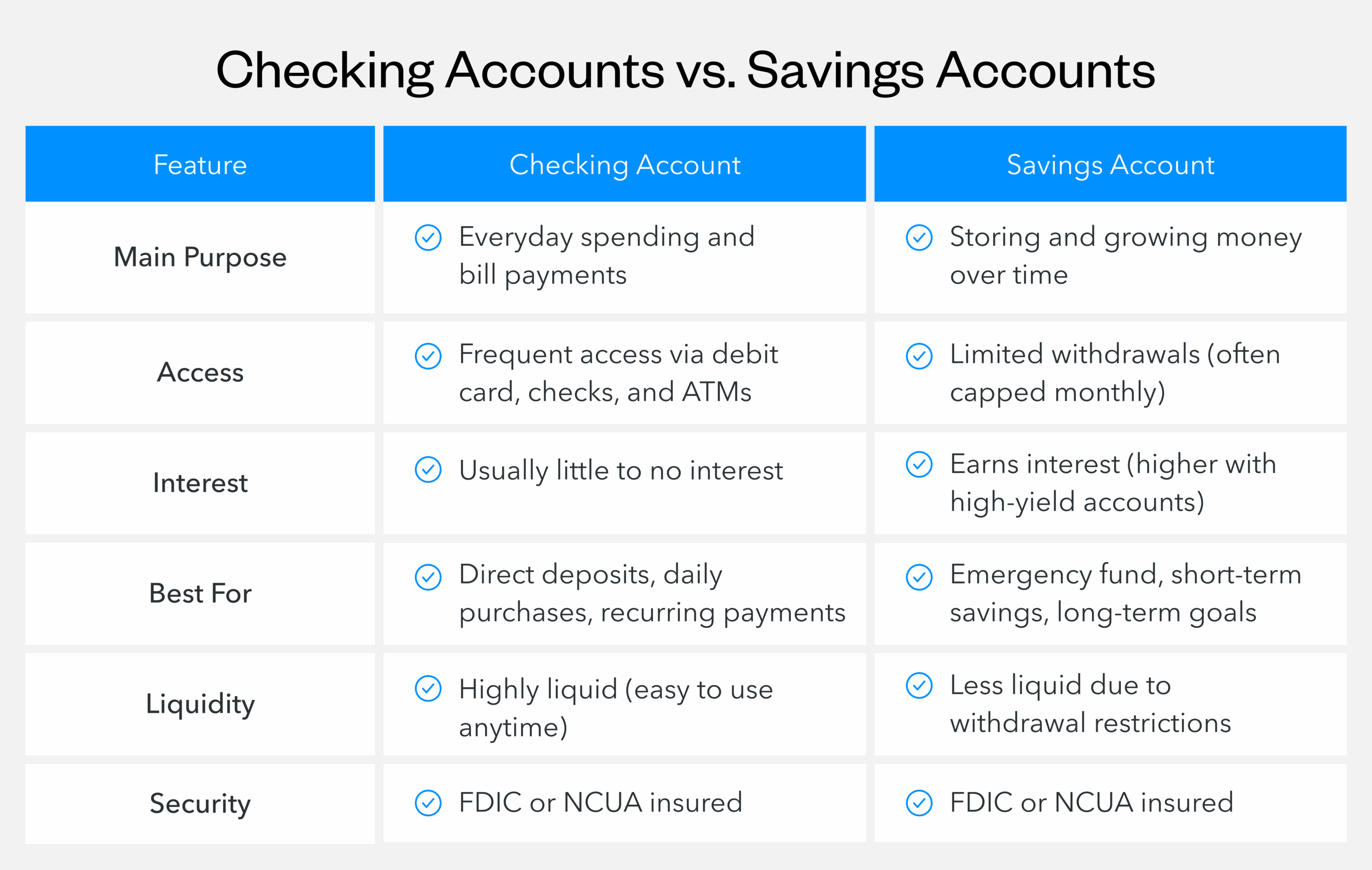

Differences Between a Checking Account vs. Savings Account

If you're wondering which account type you need, let's compare savings vs. checking accounts across the key areas that matter most:

- Access: Checking accounts let you spend money however you want, so you can make unlimited transactions without penalties. Savings accounts typically limit you to a certain number of withdrawals per month, and you usually can't get a debit card or the ability to write checks from a savings account

- Interest or dividends: Savings accounts pay higher interest rates or dividends than checking accounts. Credit unions offer particularly competitive dividend rates that can significantly outpace traditional bank interest

- Fees and minimums: Checking accounts often charge monthly fees unless you keep a certain balance, set up direct deposit or meet other requirements. Savings accounts have their own fee structures, sometimes requiring higher minimum balances to open

- Purpose: Checking accounts are built for spending money you need now. Savings accounts are built for growing money you'll need later. Every other difference between checking accounts vs. savings accounts comes from this basic purpose

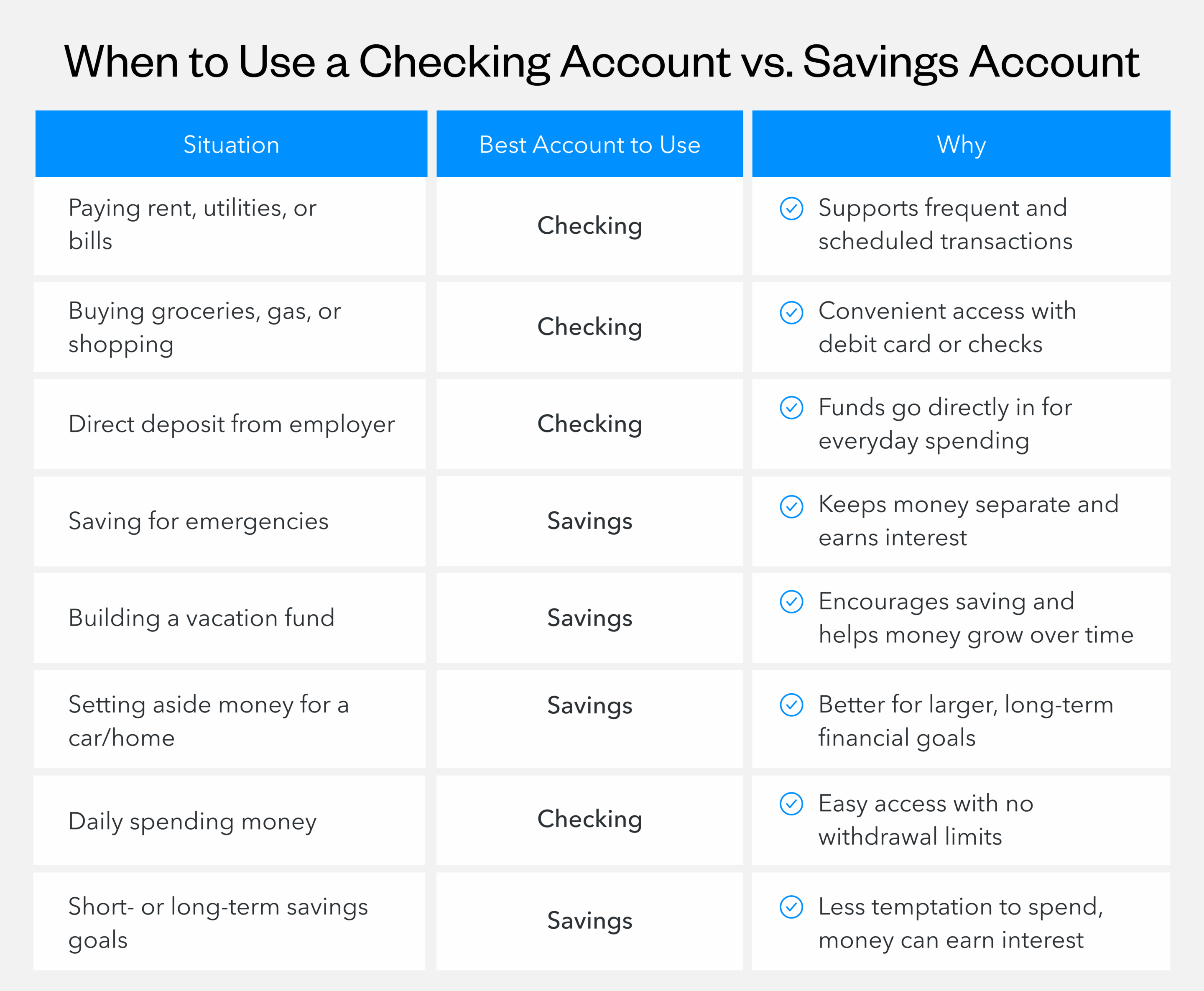

When to Use a Checking Account vs. Savings Account

Use your checking account for everything you need to pay regularly. Rent, utilities, insurance, car payments, groceries, gas, dining out and entertainment — all of this flows through your checking account. The unlimited access and payment options make it perfect for any expense you need to cover immediately.

Use your savings account for money you want to keep and grow. Emergency funds should go here because they can earn higher returns while staying accessible. You can also save for vacation funds, wedding savings, car down payments and other goals because the limited access to these accounts helps you avoid spending the money on other things.

Ultimately, you should use both accounts together. Many people set up automatic transfers from checking to savings, so they consistently build their savings while keeping spending money accessible. This keeps your immediate needs and future goals completely separate.

How to Choose Between a Checking Account vs. Savings Account

When choosing between a checking vs. savings account, consider these tips:

- Assess your spending patterns: If you pay bills regularly and need frequent access to funds, prioritize a checking account with features that match your lifestyle

- Consider your life stage: Students might benefit from a student checking account with reduced fees, while tech-savvy users may prefer an eChecking account with enhanced digital banking

- Evaluate your savings goals: For growing money over time, choose savings accounts with competitive interest rates or explore alternatives like a money market account vs. savings account options

- Compare rates and fees: Look for accounts that offer the best combination of low fees and high earnings potential for your expected balance

- Choose the same institution: Having both accounts at one credit union simplifies transfers and often reduces fees

- Consider credit union membership: Credit unions typically offer better dividend rates and lower fees than traditional banks, making the benefits of a credit union worth exploring

Wrapping Up: Understanding the Differences Between a Checking vs. Savings Account

The choice between checking vs. savings accounts doesn't have to be either-or. Most people have and use both accounts. This approach gives you both convenience and growth while keeping your finances organized.

The relationship between checking and savings accounts is just one piece of managing money well, but it's an important foundation. Understanding concepts like debit vs. credit card usage also helps you make better decisions about accessing your money from these accounts.

California Credit Union gives you great rates on both checking and savings, so you can keep your money in one place and earn more. Chat or visit with us to explore our banking solutions today.